Why Understanding Current China Tariffs is Critical for Your Business

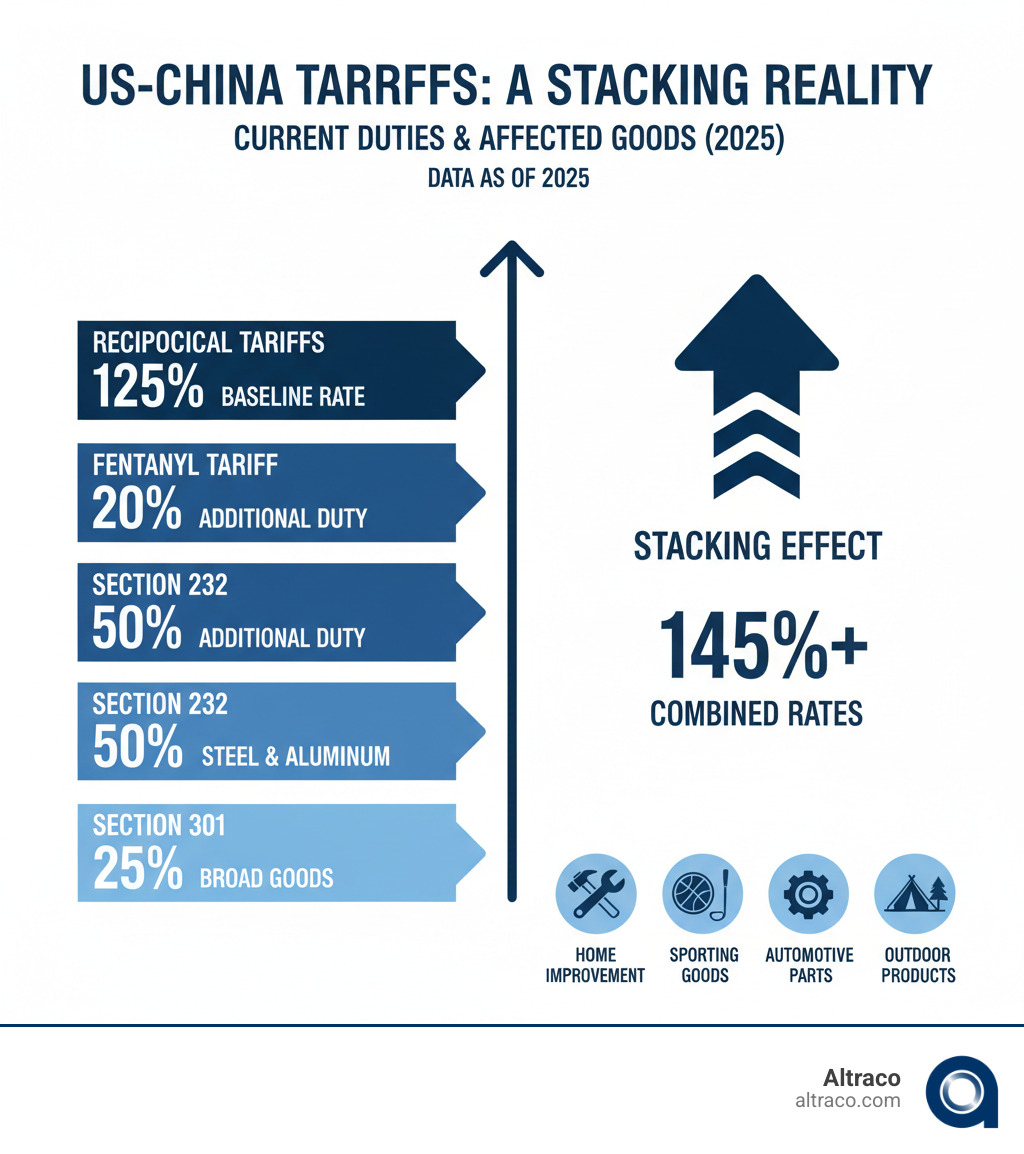

Current china tariffs have reached unprecedented levels in 2025, with some Chinese goods facing combined tariff rates exceeding 145%. Here’s what you need to know right now:

Key Current Tariff Rates:

- Section 301 Tariffs: 25% on $370+ billion of Chinese goods

- Section 232 Tariffs: 50% on steel, aluminum, copper, and auto parts

- Reciprocal Tariffs: 125% baseline rate (currently under legal challenge)

- “Fentanyl” Tariffs: 20% additional duty

- De Minimis Suspension: Small packages from China now face full tariffs

Most Affected Products:

- Home improvement goods

- Sporting goods equipment

- Automotive parts and components

- Outdoor recreation products

- Electronics and consumer goods

The tariff landscape has become a maze of overlapping duties that can stack on top of each other, creating total rates that would have been unthinkable just a few years ago. What started as targeted trade actions in 2018 has evolved into the most comprehensive tariff structure since the 1930s.

For Fortune 500 companies relying on Chinese manufacturing, these tariffs represent both a significant cost challenge and a strategic inflection point. The complexity goes beyond simple percentage calculations – it’s about understanding which products fall under which categories, how legal challenges might affect enforcement, and what alternatives exist for maintaining competitive pricing.

I’m Albert Brenner, co-owner of Altraco, a contract manufacturer that has steerd current china tariffs and trade complexities for over 40 years, helping Fortune 500 companies adapt their supply chains across China, Mexico, and Vietnam. My experience includes guiding businesses through multiple tariff escalations while maintaining quality and cost efficiency for home improvement, sporting goods, automotive, and outdoor products.

A Timeline of US-China Tariffs: How We Got Here

Understanding current china tariffs requires looking back at a trade relationship that has snowballed into one of the most complex tariff structures in modern history.

The journey began in 2018 with the first Trump administration’s Section 301 investigations into China’s unfair trade practices, particularly intellectual property theft. This led to tariffs on hundreds of billions of dollars of Chinese goods. Around the same time, Section 232 tariffs hit steel and aluminum imports from multiple countries, including China, on national security grounds, affecting over $380 billion in trade.

The Phase One Deal in February 2020 aimed to de-escalate tensions, but US tariffs on Chinese imports remained high, averaging 19.3%. The Biden administration maintained most of these tariffs while negotiating steel and aluminum agreements with other allies, leaving the China tariffs in place for a statutory four-year review.

In 2025, the returning Trump administration’s “America First Trade Policy” brought swift changes. Guided by the principle of reciprocity, as outlined in the America First Trade Policy memorandum, new reciprocal tariffs and duties targeting the fentanyl crisis were introduced, making the trade situation even more layered.

The Shift in 2025

The year 2025 has been a whirlwind for those dealing with current china tariffs. The escalation of rates has been dramatic, with the White House noting that some Chinese imports face combined tariffs of up to 245%. This figure includes a 125% reciprocal tariff, a 20% “fentanyl” tariff, and existing Section 301 tariffs.

One of the most significant changes was the suspension of the de minimis exemption. An executive order in April 2025 ended the duty-free status for packages worth $800 or less from mainland China and Hong Kong. The move had such an immediate effect that Hong Kong temporarily suspended postal services to the US, as reported by CNN Business.

The administration also launched new Section 232 investigations into critical industries like semiconductors, pharmaceuticals, heavy-duty trucks, and wind turbines, signaling potential new tariffs.

Meanwhile, the tariffs faced legal challenges. In May 2025, the US International Court of Trade ruled that the “fentanyl” and reciprocal tariffs exceeded presidential authority. The administration appealed, and while the Court of Appeals for the Federal Circuit affirmed the lower court’s decision in August, it also granted an administrative stay. This allows the contested tariffs to remain in effect during legal proceedings, adding another layer of uncertainty for businesses.

This evolving timeline underscores why flexible sourcing strategies across countries like China, Mexico, and Vietnam are now essential for manufacturers of home improvement goods, sporting equipment, automotive parts, and outdoor products.

The 2025 Guide to US Tariffs on Chinese Goods

Understanding current china tariffs in 2025 means understanding “tariff stacking,” where multiple duties apply to the same product, creating total rates that can exceed 140%. For businesses importing home improvement goods, sporting equipment, automotive parts, or outdoor products, careful calculation is essential.

The current tariff landscape consists of four main categories:

- Section 301 Tariffs: Targeting China’s intellectual property practices, these original trade war tariffs now range from 25% to 100% across 14 product groups following a statutory review.

- Section 232 Tariffs: Focused on national security, these duties have expanded beyond steel and aluminum. Rates are now 50% for steel and aluminum and 25% for automobiles and auto parts.

- Reciprocal Tariffs: Based on a “you tax us, we tax you” philosophy, these are designed to match foreign tariffs on US goods. For China, this has resulted in a 125% baseline rate.

- “Fentanyl” Tariffs: A newer 20% duty targeting goods related to the synthetic opioid supply chain, reflecting concerns about precursor chemicals.

A Breakdown of Key Tariff Rates

To calculate the true cost of importing from China, these are the rates that matter most:

- Section 301 Tariffs: Generally 25%, but can be as high as 100% for specific products.

- Section 232 Tariffs: 50% on steel and aluminum (doubled in June 2025), 25% on automobiles and auto parts (imposed in March 2025), and a new 50% tariff on copper products (effective August 1, 2025).

- Reciprocal Tariffs: A 125% rate on Chinese goods, though this has fluctuated during temporary negotiation periods.

- “Fentanyl” Tariffs: An additional 20% on goods deemed related to the opioid crisis.

Understanding the Latest Changes to the current china tariffs

Two major changes in 2025 have fundamentally altered the trade landscape. The suspension of the de minimis exemption for China and Hong Kong means that all packages, regardless of value, now face full duties and formal entry procedures. This has severely impacted e-commerce and small-batch sourcing, creating logistical problems as highlighted by CNN Business.

Additionally, ongoing legal challenges to the “fentanyl” and reciprocal tariffs create significant uncertainty. While the Court of Appeals for the Federal Circuit upheld a ruling against them, an administrative stay means businesses must continue paying these contested duties. This creates a cash-flow challenge, as companies pay now with only a possibility of future refunds if the government’s appeal ultimately fails. For manufacturers of home improvement, sporting goods, and automotive products, this legal limbo complicates financial planning.

Economic Ripple Effects: Who is Most Impacted by the current china tariffs?

Current china tariffs have created economic ripples that reshape how businesses operate and consumers shop. The effects touch everyone, from families buying household goods to Fortune 500 companies restructuring their supply chains.

US consumers feel the pinch through higher prices. A University of Chicago study found that after washing machine tariffs were imposed, prices for both washers and dryers increased significantly, by $86 and $92 respectively. Projections for 2025 suggest these tariffs could increase costs for the average US household by $1,300 annually, potentially rising to $1,600 in 2026.

US businesses face rising costs and scrambled supply chains. Companies importing components for home improvement products, sporting goods, and automotive parts have seen input costs inflate by 25% to 125% or more. Federal Reserve economists found that despite the goal of protection, overall manufacturing employment actually decreased due to tariffs, as rising costs offset gains in protected sectors. Flexport CEO Ryan Petersen warned that without policy changes, “a wave of American small businesses will go bankrupt this year.”

China’s retaliation has been swift and strategic. Beijing has imposed counter-tariffs on over $106 billion of US goods and raised its average tariff on US imports to 125%. This has hit American exporters hard, particularly in agriculture and energy. A USDA study estimated direct export losses of $27 billion from 2018-2019 alone. China has also used non-tariff barriers, such as placing US companies on “unreliable entities lists,” to create further obstacles.

Industries on the Front Line

Certain industries are in the direct crossfire of current china tariffs. Home improvement goods, sporting goods, automotive parts, and outdoor products all rely on global supply chains where every component is now more expensive. The electronics sector faces proposed 100% tariffs on semiconductors, while a new 50% tariff on copper affects a wide range of components.

On the export side, US agricultural products like soybeans and pork have been prime targets for Chinese retaliation, along with energy exports. For companies in these sectors, a single product can face multiple stacked tariffs. This is why smart manufacturers are exploring alternatives, such as diversifying to Mexico and Vietnam, to build more resilient supply chains.

Strategic Responses for Navigating the current china tariffs

When tariffs start stacking up like pancakes at a Sunday brunch, sitting still isn’t really an option. The businesses that thrive in this environment are the ones that get creative, think ahead, and build flexibility into their supply chains. After four decades of helping companies steer trade complexities, we’ve seen that the most successful responses combine smart tariff strategies with bold supply chain moves.

Tariff Engineering & Classification Review might sound technical, but it’s really about making sure you’re not paying more than you need to. Sometimes a product sits right on the border between two different tariff classifications, and a small design tweak or better understanding of the Harmonized Tariff Schedule can mean the difference between a 25% duty and a 50% one. We work with clients to dig deep into their product specifications and HTS codes, looking for legitimate ways to optimize their tariff exposure. It’s not about cutting corners – it’s about being smart with the rules as they exist.

The real game-changer, though, is supply chain diversification. The “China Plus One” strategy has moved from nice-to-have to absolutely essential. This approach means maintaining your existing relationships while building manufacturing capabilities in other countries. When current china tariffs can hit 245%, having alternatives isn’t just smart business – it’s survival.

Nearshoring to Mexico has become particularly attractive for companies serving North American markets. Mexico offers something China simply can’t: proximity. When you’re dealing with automotive parts that need quick delivery or home improvement products with seasonal demand spikes, being able to truck goods across the border instead of waiting weeks for ocean freight changes everything. The USMCA trade agreement sweetens the deal, and we’ve helped numerous clients establish manufacturing operations there that deliver both cost savings and supply chain resilience.

Vietnam and Southeast Asia present another compelling option, especially for sporting goods and outdoor products. Vietnam has built impressive manufacturing capabilities over the past decade, and while you need to watch out for transshipment rules (those 40% penalties for goods that just pass through), the country offers genuine manufacturing expertise at competitive costs. We’ve guided clients through the process of establishing relationships with Vietnamese manufacturers, ensuring quality standards while navigating the regulatory landscape.

Reshoring – bringing manufacturing back to the United States – isn’t right for every product, but it’s worth considering for high-value items or products where speed to market matters most. Yes, labor costs are higher, but when you eliminate tariffs, reduce shipping time, and gain more control over your supply chain, the math can work out surprisingly well.

The key to all these strategies is evaluating total landed cost – not just the sticker price from the factory, but every penny it takes to get your product into your customer’s hands. A basketball hoop that costs $50 to make in China might end up costing more than one that costs $65 to make in Mexico once you factor in the tariffs, shipping delays, and inventory carrying costs. We help clients run these numbers honestly, because making decisions based on incomplete cost pictures is like trying to steer with half a map.

At Altraco, we’ve spent decades building the relationships and expertise that make these transitions possible. Whether you’re looking to establish manufacturing in Mexico, Vietnam, or maintain operations in China while building alternatives elsewhere, we understand the nuances of each market and can help you build a supply chain that’s both cost-effective and resilient to whatever trade winds might blow next.

Frequently Asked Questions about US-China Tariffs

The world of current china tariffs is complex. Here are answers to some of the most common questions we hear from business owners.

What are Section 301 tariffs?

These tariffs stem from Section 301 of the Trade Act of 1974, which allows the US to address unfair trade practices. The current tariffs were initiated in 2018 to combat China’s policies on intellectual property theft and forced technology transfer. After a four-year review, current rates range from 25% to 100% across a wide variety of product groups. They form the foundational layer of duties for many goods imported from China, including home improvement, sporting, and automotive products.

How are businesses responding to the tariffs?

Companies are actively adapting rather than just absorbing costs. Common strategies include:

- Supply Chain Diversification: Adopting a “China Plus One” strategy to reduce reliance on a single country. At Altraco, we facilitate this by establishing manufacturing in Mexico and Vietnam.

- Moving Production: Shifting manufacturing entirely to more favorable locations to reduce tariff exposure and shorten lead times.

- Tariff Engineering: Legally optimizing product designs and HTS classifications to minimize duties.

- Cost Strategy: Either absorbing tariff costs to maintain market share or passing them on to consumers through higher prices.

Are any products exempt from these tariffs?

Yes, but the process is specific. The US Trade Representative (USTR) has an exclusion process where companies can apply for products to be temporarily exempted from Section 301 duties. Exclusions are granted based on factors like availability from other countries and strategic importance.

On August 29, 2025, the USTR extended 178 existing exclusions through November 29, 2025. These apply to any product matching the description, not just the original applicant. However, exclusions are temporary and can be revoked. Businesses should regularly check the USTR’s Section 301 exclusion search tool for the latest updates. While helpful, relying on exemptions is not a long-term solution; building a diversified supply chain offers more durable protection.

Conclusion: Building a Resilient Supply Chain in a Volatile World

Navigating current china tariffs feels a bit like trying to solve a puzzle where the pieces keep changing shape. What started as focused trade actions has grown into a complex web of duties that can stack up to eye-watering levels – sometimes exceeding 245% on certain Chinese goods. Whether you’re importing home improvement goods, sporting equipment, automotive parts, or outdoor products, these tariffs have fundamentally changed the cost equation for global manufacturing.

The ripple effects are real and measurable. US consumers are paying higher prices, businesses are struggling with squeezed margins, and supply chains that seemed rock-solid just a few years ago now feel fragile. The suspension of the de minimis exemption alone has turned every small package from China into a potential customs headache, while ongoing legal challenges add another layer of uncertainty to an already complex landscape.

But here’s the thing about challenges – they also create opportunities for businesses willing to adapt. The companies thriving in this environment aren’t the ones hoping tariffs will disappear (spoiler alert: they probably won’t). They’re the ones building resilient supply chains that can weather whatever trade winds blow next.

Building resilience means moving beyond the “China-only” mindset that worked so well for decades. It means embracing supply chain diversification through strategies like nearshoring to Mexico, establishing operations in Vietnam and Southeast Asia, or even bringing some production back to the US. Most importantly, it means working with partners who understand both the complexities of global manufacturing and the nuances of navigating current china tariffs.

At Altraco, we’ve spent over 40 years helping businesses – including Fortune 500 companies – build supply chains that don’t just survive disruptions, but actually use them as competitive advantages. We specialize in establishing and managing manufacturing relationships across China, Mexico, Vietnam, and other strategic locations, always with an eye toward optimizing your total landed costs, not just your unit prices.

Whether you need to engineer around specific tariff classifications, establish alternative sourcing for your automotive components, or completely restructure your supply chain for outdoor products, we bring the expertise and relationships to make it happen. Because in today’s volatile trade environment, having a manufacturing partner who can adapt as quickly as policies change isn’t just nice to have – it’s essential.

The tariff landscape will continue evolving, and new challenges will emerge. But with the right strategy and the right partner, your business can turn these challenges into competitive advantages. Improve business continuity and mitigate risks with our supply chain re-engineering solutions. Let’s build something resilient together.