Understanding the New Reality of US-China Trade

Tariffs on china have fundamentally reshaped how American businesses source and manufacture products. These tariffs, which began as a response to a 2018 Section 301 investigation into China’s intellectual property practices, have escalated into a comprehensive trade conflict affecting hundreds of billions of dollars in goods.

Current Status of Tariffs on China:

- Average tariff rate: 57.6% on Chinese goods (covering 100% of imports)

- Section 301 tariffs: 25% on approximately $370 billion of Chinese imports

- Additional tariffs: Ranging from 10% to 100% on specific products like EVs, batteries, and semiconductors

- Retaliatory measures: China has imposed 32.6% average tariffs on US goods

- Timeline: Most tariffs from the 2018-2019 trade war remain, with increases finalized in 2024-2025

Key Impact Areas:

- Automotive parts and accessories

- Sporting goods and equipment

- Home improvement products

- Outdoor products and machinery

- Critical manufacturing inputs

The reality is complex: US importers—not China—pay these tariffs directly to US Customs. These costs typically flow through to American consumers via higher prices or squeeze business profit margins. For companies managing offshore manufacturing, these tariffs represent a challenge but also an opportunity to rethink supply chain strategy by understanding which products are affected and how to build resilience through diversification.

I’m Albert Brenner, co-owner of a contract manufacturing company with over 40 years of experience. My firm has helped Fortune 500 companies steer complex trade environments, including multiple waves of tariffs on china. We’ve built proven strategies for sourcing products cost-effectively while maintaining quality and reliability as trade policies shift.

The Landscape of US Tariffs on China

To understand the current wave of tariffs on china, you need to know where it all started. In 2018, a Section 301 investigation concluded that China was engaged in forced technology transfer, cyber intrusions, and state-sponsored intellectual property theft. These findings led to a comprehensive tariff structure affecting nearly every product category, from automotive parts to sporting equipment. For businesses, understanding this landscape is no longer optional. The Complexities of Tariffs go far beyond simple percentages—they touch every aspect of global supply chain strategy.

The Rationale Behind the Trade War

The America First policy that drove these tariffs had several goals. It aimed to combat forced technology transfer and intellectual property theft, which put American innovation at risk. National security was another key concern, as officials argued that US dependence on China for critical goods like semiconductors and pharmaceuticals created dangerous vulnerabilities. The tariffs were also intended to reduce the trade deficit and encourage reshoring by making Chinese imports more expensive, with the stated goal of bringing manufacturing jobs back to the US. For more context, the US-China trade agreement provides official details on the Phase One deal.

A Timeline of Key Tariff Actions

The story of tariffs on china unfolded in waves. The Trump administration began in 2018, and by the end of 2019, Section 301 tariff lists covered over $380 billion in trade at rates of up to 25%. China responded with retaliatory tariffs on over $106 billion of US goods.

The February 2020 Phase One trade deal brought a brief pause, with the US reducing some tariffs in exchange for China’s promise to purchase more US goods—a commitment it did not fully meet. The Biden administration review largely kept the tariff structure in place, concluding that the measures should continue and, in many cases, increase.

Continued tariffs are now the new normal. Section 232 tariffs on steel and aluminum add another layer of complexity. The USTR has also finalized additional tariff hikes on strategic products like EVs, batteries, and medical supplies, with implementation dates spanning from 2024 through 2026. For businesses in sectors like home improvement, automotive, and outdoor equipment, this timeline confirms that tariffs are a permanent feature of the trade landscape requiring strategic adaptation.

What Products Are Affected by the Tariffs?

When businesses first encounter tariffs on china, the most common question is: “Does this affect my products?” The answer is often yes. The tariffs cover thousands of product categories identified by specific Harmonized Tariff Schedule (HTS) codes, which determine the duty rate for imported goods.

What began as targeted measures on industrial components has expanded to touch nearly every sector. If you’re importing home improvement products, sporting goods, automotive parts, or outdoor equipment from China, you are likely navigating these additional costs. The challenge is knowing which tariff list your products fall under and what rate applies. At Altraco, we help manufacturers decode these classifications and find practical paths forward. For a comprehensive breakdown, see our Manufacturers Guide: United States Tariffs.

Understanding the Section 301 Tariff Lists

The Section 301 tariffs rolled out in waves. List 1 and List 2 (2018) imposed a 25% tariff on over $50 billion of industrial machinery, electronics, and components. The most significant expansion came with List 3 (2018-2019), which added a 25% tariff on $200 billion of goods, including a vast range of consumer products and manufacturing inputs. This list dramatically impacted home improvement tools, sporting equipment components, automotive parts, and outdoor recreational products. List 4A (2019) followed, adding a 7.5% tariff on $300 billion of mostly finished consumer goods.

In practical terms, an automotive parts supplier sees impacts across its entire product range. A home improvement company faces higher costs for hardware and power tool components. An outdoor products manufacturer deals with increased costs on everything from tent poles to RV accessories. While some products have received temporary exclusions, a significant portion of Chinese imports now carry these additional duties.

Current and Proposed Tariff Rates on Chinese Imports

While the foundational 25% tariffs remain the baseline, recent actions have added targeted increases on strategic sectors. The USTR’s four-year review confirmed and expanded these tariffs to boost domestic production and address national security concerns.

Key sectors facing higher tariffs include:

- Steel and aluminum: 25% on steel and 10-50% on aluminum under Section 232.

- Electric vehicles (EVs): Tariffs increased to 100%.

- EV batteries and parts: Tariffs jumped to 25%.

- Semiconductors: Face 50% tariffs starting in 2025.

- Medical supplies: Tariffs on items like masks, syringes, and gloves are climbing as high as 100%.

- Other sectors: Heavy trucks, critical minerals, and maritime cargo equipment also face 25% tariffs.

For manufacturers, these increases present a challenge of higher input costs but also an opportunity for strategic diversification. By establishing manufacturing in countries like Mexico and Vietnam, companies can maintain cost competitiveness while building more resilient supply chains. We’ve helped numerous clients make this transition, leveraging our factory relationships to find the right balance of cost, quality, and tariff efficiency.

Economic Impacts and Global Reactions

The imposition of tariffs on china has sent shockwaves through the global economy, forcing businesses to rethink their trade strategies. While intended to protect US industries, these trade barriers have had complex effects on supply chains, consumer prices, and international relations. For a deeper look at this issue, see our guide on the Pros and Cons of Tariffs.

The Ripple Effect on US Businesses and Consumers

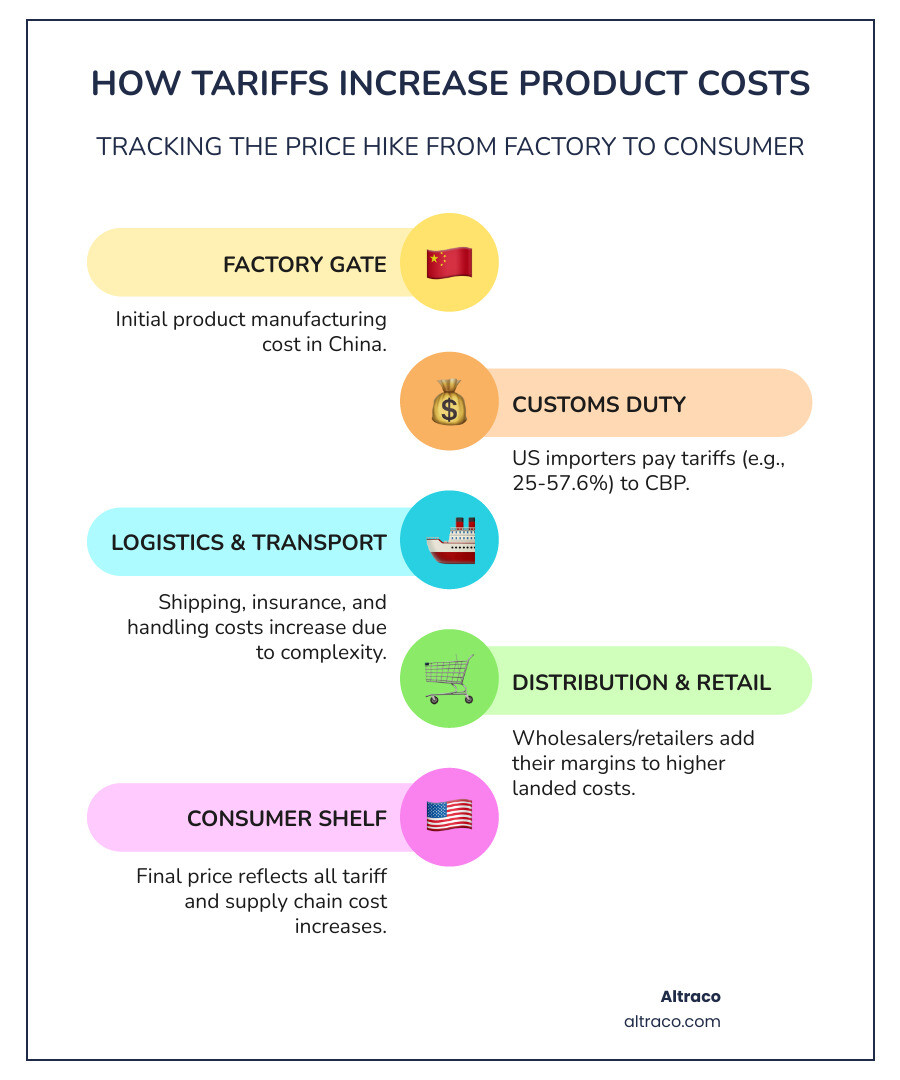

A common misconception is that China pays for these tariffs. In reality, US importers are legally obligated to pay the duties to US Customs. This has several direct consequences.

First, businesses face higher input costs. A manufacturer of home improvement tools or sporting goods sees the price of imported steel, aluminum, and electronic components rise significantly. These costs are often passed on to consumers through increased prices, contributing to inflation. The Tax Foundation estimated these tariffs could cost the average US household over $1,300 in 2025.

When businesses can’t raise prices, the tariffs eat into profit margins, limiting their ability to invest and grow. The impact on manufacturing jobs has also been complex. While some industries were protected, many downstream manufacturers faced higher component costs, leading to a net decrease in manufacturing employment according to Federal Reserve economists.

How China and Other Nations Have Responded to Tariffs on China

China’s response has been pointed. Beijing imposed retaliatory tariffs on over $106 billion of US goods, targeting key exports like agricultural products and manufactured goods. This priced many American products out of the Chinese market.

The more profound shift has been in global manufacturing patterns. In a trend known as trade diversion, companies have moved production out of China to avoid tariffs. Southeast Asian nations, particularly Vietnam, have seen a remarkable surge in manufacturing for products ranging from automotive parts to outdoor equipment. Indonesia, Malaysia, and Thailand have also become attractive alternatives.

For North American businesses, nearshoring to Mexico has become a popular strategy. Mexico offers geographic proximity, which cuts shipping times and costs, along with stable trade relations under the USMCA. We’ve helped clients establish manufacturing in Mexico for home improvement, sporting goods, and automotive components, finding it an excellent way to combine cost savings with supply chain resilience. This global realignment is not temporary; it represents a long-term shift in how and where goods are made.

Strategies for Navigating China Tariffs

The reality of tariffs on china isn’t going away. For businesses managing offshore manufacturing, waiting for policy changes is not a viable strategy. The companies that thrive are those actively building flexibility and exploring every avenue for tariff mitigation and strategic sourcing. The key is preparation and diversification. For a look at effective approaches, check out our Infographic: Proven Strategies to Steer Tariffs.

Exploring Tariff Exclusions and Mitigation

Before overhauling your supply chain, it’s worth exploring if your products qualify for relief. The Section 301 exclusion process allows businesses to apply for product-specific exemptions by demonstrating that a product is not available from domestic sources or that the tariff would cause severe economic harm. While not automatic, successful exclusions can lead to significant savings. For the latest updates, visit the Official USTR information on tariff actions.

Other strategies include tariff engineering, which involves small product modifications to change its HTS classification to a lower-duty category, and leveraging country of origin rules. If components from China undergo substantial change in a country like Vietnam or Mexico, the final product’s country of origin can change, making it exempt from Section 301 tariffs. The de minimis exemption for shipments under $800 has been suspended for Chinese goods, affecting e-commerce and small-parcel shippers.

The Role of Outsourced Manufacturing in a Tariff-Heavy World

Strategic thinking about your supply chain is where the real advantage lies. The most successful companies are rethinking where and how they manufacture.

Supply chain diversification is now essential. We have spent decades building relationships with factories across Mexico, Vietnam, Thailand, and beyond. When tariffs impact a client’s product line, we can quickly evaluate alternatives and transition production. Our guide on Outsourced Manufacturing: The Guide to Navigating US Tariffs details how this works in practice.

Mexico has become a top choice for North American manufacturers due to logistical advantages and stable trade under USMCA. We’ve helped clients move production for home improvement, automotive, and sporting goods to Mexico, achieving competitive costs once tariffs and logistics are factored in. Southeast Asia, particularly Vietnam, also continues to absorb manufacturing capacity shifting from China, offering a mature infrastructure for many product categories.

A thorough cost-benefit analysis must go beyond factory price to include landed cost, logistics, and quality. Building genuine resilience means not relying on a single country. By maintaining relationships with factories in multiple regions, businesses can pivot when disruptions occur. That flexibility is invaluable in today’s trade environment.

Frequently Asked Questions about Tariffs on China

If you’re trying to make sense of tariffs on china, you’re not alone. Here are straight answers to the questions we hear most often from our clients.

How are Section 301 tariffs different from other tariffs?

Section 301 tariffs specifically target what the US government deems “unfair trade practices” by China, particularly concerning technology transfer and intellectual property. Other tariffs serve different purposes: Section 232 tariffs address national security (e.g., steel and aluminum), Section 201 tariffs are “safeguard” measures to protect domestic industries from import surges, and IEEPA tariffs are used during national emergencies. The key difference is that Section 301 is a direct response to China’s systemic trade policies.

Who actually pays for the tariffs on China?

Despite political rhetoric, China does not pay the tariffs. US importers—American companies bringing goods into the country—are legally required to pay these duties to U.S. Customs and Border Protection. It is effectively a tax on imported goods. These costs are then either passed on to consumers through higher prices or absorbed by businesses, which squeezes their profit margins. Economic analyses confirm that US businesses and consumers ultimately bear the financial burden of these tariffs.

Are the tariffs on China likely to end soon?

It is unlikely that these tariffs on china will disappear in the near future. The strategic competition between the US and China over technology, national security, and industrial policy runs deep. The USTR’s recent four-year review recommended keeping and even increasing tariffs on key sectors, and there is a rare bipartisan consensus on maintaining a tough trade stance with China. While specific rates may change, the overall tariff framework appears to be a long-term feature of US trade policy. This is why we emphasize supply chain diversification as a core business strategy.

Conclusion: Building a Resilient Supply Chain

The landscape of tariffs on china isn’t going away anytime soon. What we’re seeing is a fundamental reshaping of how global trade works, and for businesses engaged in offshore manufacturing, this means rethinking strategy from the ground up.

Here’s the reality: tariffs have become a permanent feature of the US-China trade relationship. The strategic competition between these two economic powers, combined with bipartisan political support for tough trade measures, means your business needs to plan for the long haul. This isn’t about waiting for things to go back to “normal”—this is the new normal.

But here’s the good news: with the right approach, these challenges can actually become opportunities to build something better. A more resilient supply chain. More flexibility. Better risk management. And yes, even cost savings.

At Altraco, we’ve spent over 40 years helping businesses steer exactly these kinds of challenges. We’ve guided Fortune 500 companies and smaller manufacturers through multiple waves of trade policy changes, and we know what works. Our expertise in tariff navigation isn’t theoretical—it’s built on decades of real-world problem-solving for companies just like yours.

We specialize in helping you diversify your manufacturing footprint across strategic locations worldwide. Whether that means establishing production in Mexico to take advantage of nearshoring benefits, tapping into Vietnam’s growing manufacturing capabilities, or exploring other emerging markets, we have the factory relationships and expertise to make it happen smoothly.

For manufacturers of home improvement products, we can help you source everything from power tools to hardware components in tariff-advantaged locations. Sporting goods companies benefit from our connections with specialized factories that understand quality control and performance standards. If you’re in automotive parts, we know how to manage the complex requirements of this industry while keeping costs competitive. And for outdoor products—from camping gear to recreational equipment—we’ve built supply chains that can weather any storm.

What sets us apart is simple: we don’t just find you a factory and walk away. We become your partner in building a truly resilient supply chain. That means ongoing quality control, logistics management, tariff strategy, and the kind of hands-on support that comes from being in this business for four decades.

The tariff environment will continue to evolve. New rates will be announced. Exclusions will come and go. But with a diversified, strategically planned supply chain, your business can stay profitable and competitive regardless of what Washington or Beijing decides next.

Don’t let tariffs dictate your business strategy. Take control by partnering with someone who’s been navigating these waters successfully for longer than most of us have been thinking about global trade.

Ready to transform these challenges into competitive advantages? Learn how to steer tariffs on China for your California-based business and find how Altraco’s expertise in navigating global manufacturing can help you build the resilient supply chain your business needs to thrive.