Why Trade Compliance is Critical for Your Global Operations

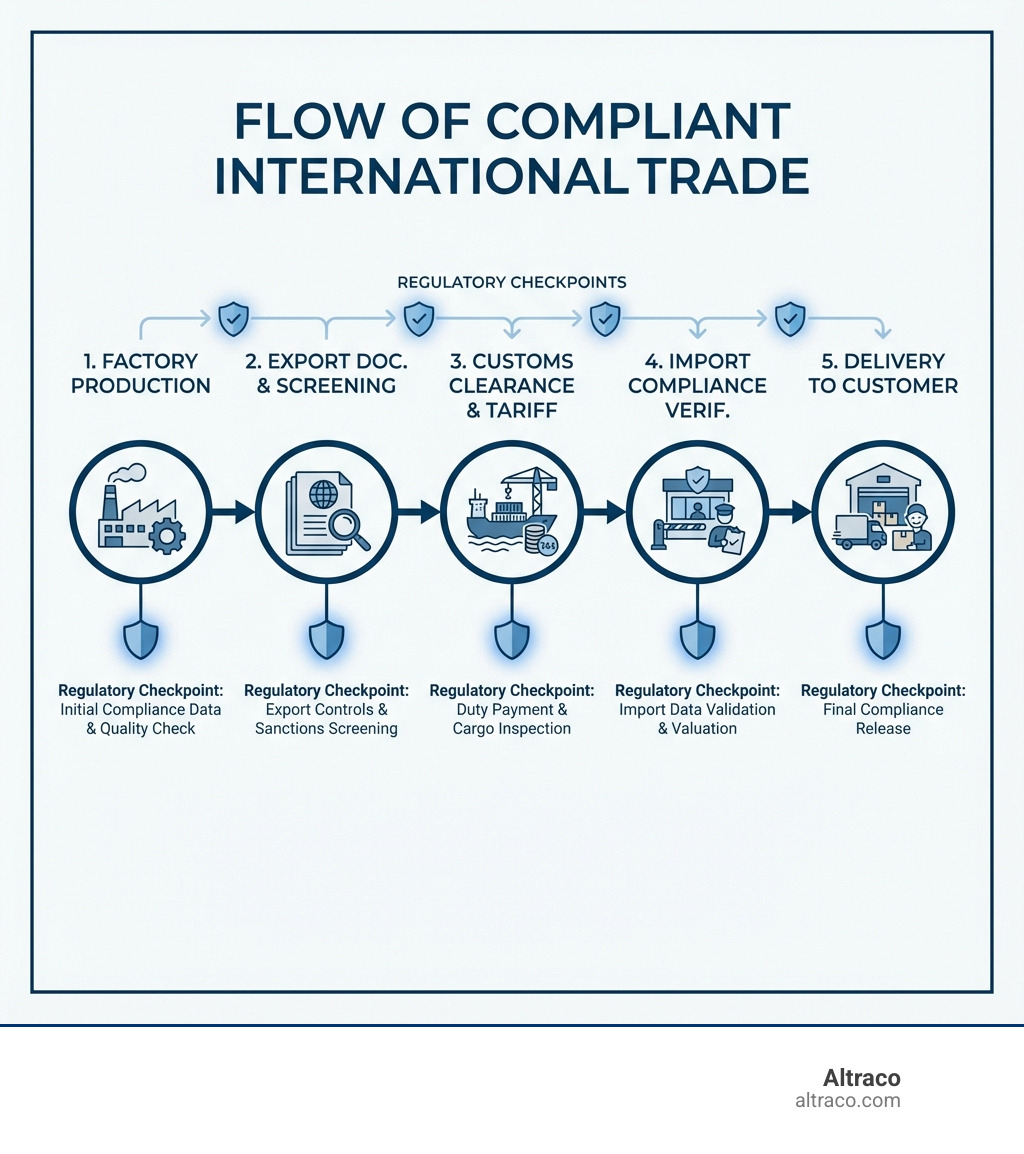

Trade compliance is the set of processes and procedures that ensure your business adheres to all domestic and international laws, regulations, and requirements when importing or exporting goods. It encompasses everything from proper tariff classification and customs valuation to export controls and sanctions screening.

What Trade Compliance Covers:

- Import Compliance: Managing customs duties, tariff classifications, rules of origin, and regulatory requirements when bringing goods into a country

- Export Compliance: Adhering to export controls, licensing requirements, and screening for sanctioned parties when shipping goods internationally

- Key Responsibilities: Accurate documentation, proper valuation, correct classification codes, sanctions screening, and license management

- Shared Accountability: Both businesses and government agencies (like U.S. Customs and Border Protection) work together to ensure compliance

Why It Matters:

Trade compliance failures can result in shipment delays, financial penalties ranging from thousands to millions of dollars, seizure of goods, criminal sanctions, and severe reputational damage. In recent enforcement actions, CBP collected $1 billion after addressing compliance loopholes, demonstrating the government’s serious approach to enforcement.

For Fortune 500 companies managing complex global supply chains, trade compliance isn’t just about avoiding penalties—it’s about protecting margins, ensuring on-time delivery, and maintaining the competitive advantages that come from reliable international sourcing.

The stakes are particularly high when manufacturing across multiple countries. Whether you’re sourcing automotive parts from Vietnam, sporting goods components from China, or outdoor products from Mexico, every shipment must steer a maze of regulations that change frequently due to geopolitical shifts, new trade agreements, and emerging enforcement priorities.

I’m Albert Brenner, and over the past 40 years of operating a contract manufacturing company, I’ve helped Fortune 500 clients steer the complexities of trade compliance while manufacturing home improvement products, sporting goods, automotive parts, and outdoor equipment across multiple countries. Through thousands of shipments and constant regulatory changes—including recent Supreme Court tariff decisions—we’ve learned that proactive compliance management transforms a potential liability into a strategic advantage.

The Core Pillars of Global Trade Compliance

This section covers the foundational elements every business must manage for successful international trade. Think of these as the bedrock upon which all other trade compliance efforts are built. Ignoring any of these pillars is like trying to build a house on quicksand—it might look fine for a bit, but it’s bound to collapse.

To help establish a global framework, key international organizations play a vital role. The World Trade Organization (WTO) sets rules for international trade, aiming to ensure trade flows as smoothly, predictably, and freely as possible. Complementing this, the World Customs Organization (WCO) focuses on customs matters, developing international instruments and tools to facilitate trade and ensure secure borders. Their work directly impacts how we classify goods, determine their origin, and value them for customs purposes.

Tariff Classification: The Harmonized System (HS)

At the heart of international trade lies the Harmonized System (HS) for classifying goods. This universal nomenclature, maintained by the WCO, provides a standardized way to describe products being traded across borders. Imagine trying to explain every single component of a complex automotive part to customs officials in different languages without a common system – it would be a logistical nightmare!

HS codes are typically six-digit codes that categorize products into thousands of groups. This classification is not just an administrative formality; it’s a critical legal responsibility for both importers and exporters. Why? Because the HS code directly determines:

- The applicable duty rates and taxes.

- Whether specific permits or licenses are required.

- If anti-dumping or countervailing duties apply.

- The collection of accurate international trade statistics.

An incorrect HS classification can lead to serious repercussions, including fines, penalties, shipment delays, increased inspections, or even the seizure of goods. The numbers speak for themselves: over 98% of the merchandise in international trade is classified in terms of the HS, underscoring its universal importance. We understand the nuances of this system, especially for complex items like home improvement materials or outdoor gear, and can guide you through the process to ensure accuracy. For a deeper dive into tariffs, explore our Tariff Guide for Business.

Rules of Origin (RoO)

Beyond what a product is, where it comes from is equally crucial. Rules of Origin (RoO) are the specific provisions applied by a country to determine the economic nationality of goods. This isn’t always as simple as where the final assembly happens; it can involve where raw materials are sourced or where significant value is added.

RoO are vital because they impact:

- Preferential Treatment: Goods originating from countries with which a trading partner has a free trade agreement (FTA) may qualify for reduced or zero tariffs.

- Trade Restrictions: They determine if goods are subject to quotas, anti-dumping duties, or other trade policy measures.

- Labeling Requirements: Many countries require products to be labeled with their country of origin.

For example, an automotive part manufactured in Mexico using components from various countries would need careful origin determination to qualify for preferential treatment under USMCA (formerly NAFTA) when imported into the U.S. Misinterpreting these rules can lead to significant unexpected costs or even penalties. We assist our clients in understanding these complexities, especially when navigating specific regulations like those related to Section 301 Tariffs on goods from China.

Customs Valuation

Once we know what a product is and where it comes from, we need to determine its value. Customs valuation is the process of assigning a monetary value to imported goods for the purpose of assessing duties and taxes. This value is typically the “transaction value”—the price actually paid or payable for the goods when sold for export to the country of importation.

The WTO Customs Assessment Agreement outlines six different valuation methodologies, with the transaction value being the primary method. If that cannot be determined, then alternative methods (like the value of identical or similar goods) are used.

Correct valuation is paramount. Overvaluation leads to paying more duties than necessary, eroding your profit margins. Undervaluation, on the other hand, can trigger intense scrutiny from customs authorities, resulting in delays, fines, and penalties. For us, ensuring accurate valuation for your home improvement, sporting goods, or outdoor products means protecting your bottom line and maintaining a smooth supply chain.

Incoterms® Rules

Think of Incoterms® rules as the universal language of international trade contracts. Published by the International Chamber of Commerce (ICC), these internationally recognized terms define the responsibilities of buyers and sellers for the delivery of goods under sales contracts. They clarify:

- Tasks: Who does what (e.g., arranging transport, obtaining insurance).

- Costs: Who pays for what (e.g., freight, insurance, customs duties).

- Risks: Where and when the risk of loss or damage to goods transfers from seller to buyer.

Using the correct Incoterms® rule for your contract manufacturing projects—whether it’s for automotive parts from Vietnam or home improvement products from China—is crucial. It prevents costly misunderstandings, disputes, and delays. For instance, knowing whether you’re shipping EXW (Ex Works) or DDP (Delivered Duty Paid) dramatically changes your obligations and exposure. We always ensure these terms are clearly stated on relevant shipping documents. To get a quick overview, you can download a free Incoterms® 2020 wallchart.

Navigating Import and Export Compliance Challenges

The global movement of goods is a complex ballet, and understanding the specific challenges of importing versus exporting is key to a flawless performance. While both fall under the umbrella of trade compliance, they each have unique regulatory landscapes and requirements.

In the United States, several key government agencies oversee and enforce trade compliance. These include:

- U.S. Customs and Border Protection (CBP): The primary agency responsible for securing U.S. borders and facilitating legitimate trade. They handle imports, collect duties, and enforce hundreds of laws for other government agencies.

- Bureau of Industry and Security (BIS): Part of the U.S. Department of Commerce, BIS regulates the export and re-export of most commercial and “dual-use” items (goods that have both commercial and military applications) through the Export Administration Regulations (EAR).

- Office of Foreign Asset Controls (OFAC): Part of the U.S. Department of the Treasury, OFAC administers and enforces economic and trade sanctions based on U.S. foreign policy and national security goals against targeted foreign countries and regimes, terrorists, international narcotics traffickers, those engaged in activities related to the proliferation of weapons of mass destruction, and other threats to the national security, foreign policy or economy of the United States.

Key Considerations for Import Compliance

When we bring goods into the United States, we assume the critical role of the Importer of Record (IOR). This isn’t just a title; it comes with significant responsibilities. As the IOR, we are legally accountable for:

- Reasonable Care: Exercising “reasonable care” in providing CBP with accurate and timely information to ensure proper classification, valuation, and country of origin determination. This means doing our homework and having robust internal processes.

- Partner Government Agency (PGA) Requirements: Many imported goods, especially those like automotive parts, sporting goods, or home improvement items, are regulated not just by CBP but also by other U.S. government agencies. For example, some automotive parts might fall under Department of Transportation (DOT) regulations, while certain outdoor products could be subject to environmental agency rules. We must ensure compliance with all applicable PGA requirements.

- De Minimis Entry: A small but significant detail! For qualified imports with a fair retail value of not more than $800, CBP may provide an exemption from duty and tax. This “de minimis” threshold can simplify processes for smaller shipments, but it’s crucial to understand its limitations and proper application.

Navigating import regulations can be tricky, especially with specific state-level considerations. For insights into import taxes in California, you might find our article on US Import Tax California helpful. For a broader overview, CBP provides a comprehensive guide on Basic Importing and Exporting.

Understanding the Export Compliance Landscape

Exporting goods from the U.S. comes with its own set of rules, and as the Exporter of Record (EOR), we bear the primary responsibility for adherence. Key regulations include:

- Export Administration Regulations (EAR): Administered by BIS, the EAR controls the export and re-export of most commercial goods, including many of the home improvement, sporting goods, automotive parts, and outdoor products we help manufacture. Items are categorized on the Commerce Control List (CCL), and their destination, end-user, and end-use dictate licensing requirements.

- International Traffic in Arms Regulations (ITAR): Administered by the Directorate of Defense Trade Controls (DDTC), ITAR controls defense articles and services. While our focus is on commercial products, be aware of ITAR, especially if any components or technologies could be considered “military-use.”

- Deemed Exports: This is a fascinating concept! A “deemed export” occurs when technology or source code is released to a foreign national within the U.S. This could be in a research lab, during a factory visit, or even through casual conversation. If that technology is controlled for export to the foreign national’s home country, an export is “deemed” to have occurred, requiring a license. This highlights the need for stringent internal controls, even within our California facilities. For a deeper understanding of U.S. export controls, consider this Introduction To U.S. Export Controls.

Obtaining an Import or Export License

Not all goods can simply cross borders with just an HS code and a prayer. Some require specific licenses. When is a license needed?

- Controlled Goods: Certain products are deemed “controlled” due to their nature, such as advanced electronics in automotive parts, specific chemicals in home improvement products, or high-tech components in outdoor equipment.

- Dual-Use Items: As mentioned with the EAR, items that have both commercial and potential military applications often require export licenses.

- Sanctioned Destinations/End-Users: If you’re exporting to certain countries or to specific individuals/entities on restricted party lists, a license will almost certainly be required, regardless of the product.

The application process for an import or export license typically involves submitting detailed documentation to the relevant national customs agency or regulatory body (e.g., BIS for exports, or specific PGAs for imports). This can be a meticulous and time-consuming process, but it’s non-negotiable for compliance. Our expertise in International Sourcing Services includes navigating these licensing requirements, ensuring your manufacturing projects in Mexico, China, or Vietnam proceed without unnecessary problems.

Building a Robust Trade Compliance Program

A reactive approach to trade compliance is like waiting for a flood to build a dam—it’s usually too late and far more costly. A proactive, robust compliance program is not just a shield against penalties; it’s a strategic asset that protects your supply chain, improves your reputation, and ultimately drives business growth.

One of the foundational aspects of a strong program is cross-departmental integration. Trade compliance isn’t just for the logistics team. It requires a symphony of collaboration across:

- Legal: To interpret complex regulations and advise on risk.

- Operations: To implement compliant processes in manufacturing and shipping.

- Sales: To ensure contracts reflect correct Incoterms® and destinations are screened.

- Procurement: To vet suppliers for compliance with anti-forced labor laws and sanctions.

- Finance: To manage duties, taxes, and payment processes.

Every department has a role to play in the larger compliance picture.

Establishing Your Compliance Team and Manual

Whether you’re a lean startup or a large enterprise, you need dedicated resources for trade compliance. This could be a dedicated team, or for smaller organizations, a designated individual who champions compliance and works across departments. Key skillsets for this role include:

- Regulatory Expertise: Deep knowledge of EAR, ITAR, OFAC, CBP regulations, and international trade agreements.

- Analytical Skills: To interpret complex data and identify potential risks.

- Communication Skills: To educate internal stakeholders and liaise with external agencies.

- Attention to Detail: To ensure accurate documentation and meticulous record-keeping.

A cornerstone of any effective program is a comprehensive compliance manual. This living document should:

- Document Policies and Procedures: Clearly outline how your company handles HS classification, rules of origin, valuation, licensing, and screening.

- Assign Responsibilities: Define who is responsible for each compliance task.

- Provide Training Guidelines: Ensure all relevant employees receive ongoing education.

- Outline Escalation Procedures: What to do when a potential violation is identified.

Regular internal reviews and audits are essential to test the effectiveness of your manual and procedures. This helps us identify gaps before they become costly problems, ensuring our contract manufacturing operations in places like Mexico and Vietnam remain seamless.

Screening for Sanctions and Forced Labor

In today’s global landscape, merely knowing what you’re shipping and where isn’t enough. You also need to know who you’re doing business with. This is where robust screening comes into play.

- Denied Party Screening (DPS): This involves checking potential customers, suppliers, and other business partners against various government-issued restricted party lists. The Office of Foreign Asset Controls (OFAC) maintains several such lists, detailing individuals, entities, and countries with whom U.S. persons are generally prohibited from doing business. Conducting DPS isn’t a one-time task; it should be an ongoing process, as lists are frequently updated.

- Sanctioned Countries: Be aware of comprehensive sanctions programs against entire countries, which broadly prohibit most transactions involving those jurisdictions.

- Forced Labor: This is an increasingly critical area. The Uyghur Forced Labor Prevention Act (UFLPA) in the U.S. creates a rebuttable presumption that goods produced in Xinjiang, China, are made with forced labor and thus prohibited from entering the U.S. market. This places a heavy burden of proof on importers. For companies like ours, manufacturing in China and other regions, rigorous supplier due diligence is non-negotiable. We proactively work to ensure our supply chains are free from forced labor, building Strong Supplier Relationships that are transparent and ethical.

Leveraging Government and External Support

You don’t have to steer the complexities of trade compliance alone. Government agencies often provide resources, and experienced external partners can be invaluable.

- Government Agencies: The International Trade Administration (ITA) offers extensive resources and guidance for U.S. businesses engaged in international trade. CBP also provides various programs and tools.

- Customs Brokers: These licensed professionals act as intermediaries between importers and customs authorities, handling documentation, duties, and clearance procedures.

- Foreign Trade Zone (FTZ) Consultants: For businesses with significant import/export volumes, FTZs can offer benefits like duty deferral or reduction. Consultants can help evaluate and implement FTZ strategies.

Working with experienced partners, whether they are government resources or private consultants, is a smart way to bolster your compliance efforts. At Altraco, our decades of experience in global sourcing and contract manufacturing for home improvement, sporting goods, automotive parts, and outdoor products mean we’ve built strong relationships and deep expertise to help you stay compliant.

The Future of Trade Compliance: Technology and Global Shifts

The world of trade compliance is anything but static. Geopolitical shifts, rapid technological advancements, and unforeseen global events constantly reshape the regulatory landscape. Staying ahead means being adaptable and leveraging every tool at your disposal.

We’ve seen how quickly things can change, leading to tariff volatility and impacting global supply chain resilience. Remember the complexities introduced by the Section 301 tariffs on Chinese goods? These kinds of changes highlight the need for a nimble and informed approach to trade compliance. For more on this, we’ve explored the Complexities of Tariffs in detail.

The Role of Technology in Modern Trade Compliance

Gone are the days when trade compliance was solely a manual, paper-driven process. Technology has revolutionized how we manage compliance, turning it into a more efficient and less error-prone function.

- Automation Software: This streamlines routine tasks like document generation, data entry, and record-keeping, significantly reducing the administrative burden.

- AI-Powered Solutions: Artificial intelligence (AI) is a game-changer. It can rapidly screen vast amounts of data against denied party lists, analyze trade patterns, and even assist with classification. One solution, Descartes Visual Compliance™, has reportedly saved companies nearly 28,000 man-hours per year and reduced compliance risk. Another client, Argosy International Inc., realized a 75% productivity gain in their compliance practice by automating screening.

- Automated Screening: This capability allows us to check every order as it comes in, with manual intervention only required when a flag is raised. This minimizes false positives and frees up our compliance teams to focus on more strategic activities, such as training and internal stakeholder engagement.

These technological advancements mean we can achieve higher compliance rates with greater efficiency, ensuring that our clients’ automotive parts, sporting goods, and home improvement products move smoothly through the global supply chain.

Adapting Your Trade Compliance Strategy to a Changing World

Recent global events have underscored the critical need for agile trade compliance strategies.

- Impact of Global Events: The COVID-19 pandemic, for example, led to unprecedented supply chain disruptions and rapidly changing import/export restrictions as countries prioritized essential goods and implemented new controls. This forced businesses to quickly adapt their compliance practices and supply chain routes.

- Supply Chain Reshaping: These disruptions, coupled with geopolitical tensions, have accelerated trends like nearshoring and friend-shoring. Companies are increasingly diversifying their manufacturing locations to reduce reliance on single regions. For instance, we’ve seen a significant increase in interest in Mexico Manufacturing and Vietnam Manufacturing as viable alternatives or complements to traditional sourcing hubs, especially for products like outdoor gear and home improvement items. This strategic shift requires careful trade compliance planning for each new manufacturing location.

- Legal and Policy Shifts: We must also remain vigilant about evolving legal frameworks. For example, recent U.S. Supreme Court decisions regarding tariffs can have profound implications for global sourcing strategies and the cost of goods. Such decisions can alter the economic viability of manufacturing in certain countries and necessitate a re-evaluation of tariff mitigation strategies. Staying informed and agile in response to these legal and policy shifts is paramount to maintaining competitive advantage.

Conclusion: Turning Compliance into a Strategic Advantage

We’ve journeyed through the intricate world of trade compliance, from its core pillars like tariff classification and rules of origin, to the distinct challenges of importing and exporting, and finally, to the transformative role of technology and adaptation in a dynamic global landscape.

The key takeaway is clear: trade compliance is far more than a regulatory burden. When approached proactively and strategically, it becomes a powerful business enabler. By ensuring meticulous adherence to international laws, you’re not just avoiding penalties; you’re protecting your margins, de-risking your shipments, and safeguarding your brand’s reputation. This diligence helps ensure your valuable home improvement, automotive parts, sporting goods, and outdoor products arrive on time and within budget.

For companies engaged in strategic sourcing for home improvement, automotive parts, sporting goods, and outdoor products, leveraging trade compliance expertise opens up significant opportunities for cost savings and quality assurance. Our experience in contract manufacturing in Mexico, China, Vietnam, and other countries allows us to steer these complexities, turning potential liabilities into competitive advantages for our clients.

At Altraco, we simplify global supply chains through expert contract manufacturing and tariff navigation. We leverage decades of experience and trusted factory relationships to deliver quality, on-time products with significant cost savings. Let us help you turn complex regulations into a competitive advantage.

Partner with Altraco to optimize your international sourcing services today.