Why Understanding China Duty Impact Matters More Than Ever

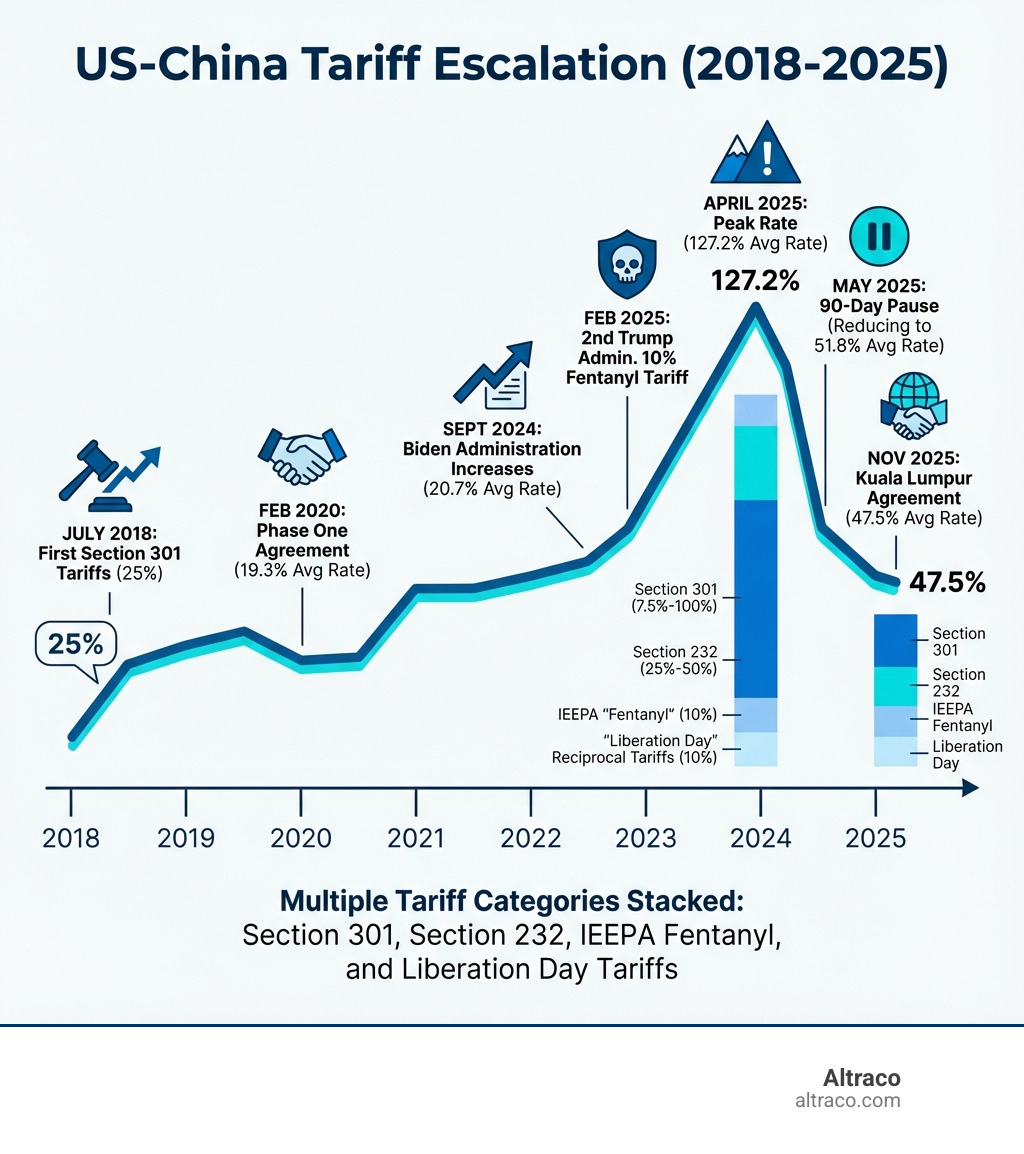

China duty impact refers to the economic consequences of tariffs on US-China trade, affecting import costs, supply chains, and consumer prices. The landscape has transformed since 2018, evolving from a focused dispute into a complex web of overlapping duties and economic disruptions. For businesses relying on contract manufacturing, the stakes have never been higher.

Current Tariff Landscape (as of November 2025):

- Average US tariff on Chinese imports: 47.5%

- Average Chinese tariff on US exports: 31.9%

- Key tariff categories: Section 301 (7.5%-100%), Section 232 (25%-50%), IEEPA “Fentanyl” (10%), and reciprocal tariffs (10%)

Direct Impact on Businesses:

- Average tax increase of $1,100 per US household in 2025

- Multiple tariffs can stack on a single product, with final rates exceeding 100%

- Estimated 0.7% reduction in long-run US GDP due to tariffs and retaliation

The numbers tell a stark story. US tariffs on Chinese goods are now over 15 times higher than before the trade war. When importing automotive parts, sporting goods, or outdoor products, you’re not dealing with one rate but a maze of stacked duties. A single product can face cumulative tariffs over 100%.

Beyond cost, supply chains face uncertainty from legal challenges to these tariffs winding through federal courts. Meanwhile, China has responded with its own retaliatory measures, including high tariffs on US goods and export controls on rare earth minerals. For companies managing offshore manufacturing, this creates a critical challenge: how do you maintain cost efficiency and on-time delivery when the tariff landscape is constantly shifting?

I’m Albert Brenner. For over 40 years, my firm has guided companies, including Fortune 500 clients, through multiple tariff cycles by building resilient contract manufacturing relationships in China, Mexico, and Vietnam. We’ve weathered trade wars and policy shifts, helping clients manage the real-world China duty impact on their bottom line.

A Tangled Web: Deconstructing the Current US Tariffs on China

The current US tariff landscape on Chinese imports is a layered system of duties from various legislative acts and presidential actions. Understanding these categories is the first step in comprehending the full China duty impact.

Section 301 Tariffs: The Original Trade War Weapon

At the heart of the trade war are Section 301 tariffs, imposed in 2018 to address China’s unfair trade practices like intellectual property theft. Initially ranging from 7.5% to 25%, a 2024 review led to even higher tariffs on strategic products. For example, electric vehicles (EVs) now face a 100% tariff, while semiconductors and certain medical supplies see rates of 25% to 50%, rolling out through early 2026.

Navigating these duties requires expert knowledge. For more detailed information on how to manage these specific tariffs, we encourage you to explore our guide on More info about navigating these duties.

Section 232 Tariffs: National Security Duties

Separate from Section 301, Section 232 tariffs are justified on national security grounds to protect vital domestic industries. While initially targeting steel and aluminum, their scope has expanded. In 2025, rates on aluminum and steel were raised, and new tariffs were added for derivative products. For instance, a 25% tariff now applies to many automobiles and auto parts, stacking on top of existing Section 301 duties. A 50% tariff was also imposed on certain copper products, impacting industries that produce automotive parts, home improvement components, and outdoor products.

IEEPA and “Special” Tariffs: Fentanyl and “Liberation Day”

The International Emergency Economic Powers Act (IEEPA) grants the President broad authority to impose “special” tariffs during a national emergency, adding another layer to the China duty impact.

One example is the 10% “fentanyl” tariff, imposed on all Chinese goods in early 2025. Another is the “Liberation Day” or reciprocal tariffs, which were announced as a universal 10% duty but rapidly escalated against China before being paused. The legality of using IEEPA for these tariffs faces significant legal challenges, with the US Court of Appeals for the Federal Circuit set to rule on the matter. This ongoing legal battle adds another layer of uncertainty to the trade environment.

The Bottom Line: Calculating the True China Duty Impact

The China duty impact isn’t just about percentages; it’s about real economic effects on consumer costs, business revenue, and US GDP. For businesses in contract manufacturing of automotive parts, sporting goods, or home improvement items, these impacts hit the bottom line directly.

Current Tariff Rates and Affected Products

As of November 2025, the average US tariff on Chinese goods is 47.5%, with China’s average tariff on US goods at 31.9%. The key challenge is “tariff stacking,” where multiple duties (Section 301, IEEPA, etc.) apply to the same product. This cumulative effect can push the final tariff rate well over 100% for some goods, making it incredibly difficult to maintain competitive pricing.

The Economic Ripple Effect on Businesses and Consumers

Tariffs are taxes, and research consistently shows these costs are passed on to US businesses and consumers through higher prices. A 2019 study found tariffs on Chinese imports were almost fully passed through to US import prices, reducing profit margins and consumer purchasing power. These trade barriers are estimated to cost the average US household an extra $1,100 in 2025. While some protected industries may see small gains, rising input costs and retaliatory tariffs often lead to a net decrease in overall manufacturing employment.

Understanding the Broader China Duty Impact on the US Economy

The China duty impact extends to the entire US economy. While tariffs are projected to increase federal revenue, this is partially offset by reductions in income and payroll tax bases. The overall economic costs are substantial. When combined with retaliatory measures, the tariffs are estimated to reduce long-run US GDP by 0.7%. These costs are not distributed evenly; tariffs tend to disproportionately affect lower-income households, who spend a larger share of their income on goods now subject to higher prices.

The Other Side of the Coin: China’s Retaliatory Measures and Global Shifts

The US-China trade relationship is a two-way street. China has responded to US tariffs with its own retaliatory measures, complicating the global trade environment and forcing businesses to rethink their supply chains.

China’s Counter-Tariffs: A Tit-for-Tat Evolution

China’s response has included raising its average tariff on US goods and targeting a wide array of products, from agricultural goods like soybeans to manufactured items. Beyond tariffs, China has used non-tariff countermeasures, such as suspending certain imports, adding US firms to restriction lists, and imposing export controls on critical materials like rare earth minerals. These actions are designed to exert economic pressure on specific US industries.

Navigating Exemptions, Exclusions, and Expirations

Both the US and China have offered temporary tariff exemptions and exclusions for certain products, which can provide crucial relief. The US Trade Representative (USTR), for example, has extended tariff exclusions on 178 Chinese products until late 2026. However, these processes are often temporary and require diligent monitoring, as China’s own exemption extensions have recently expired. This constant flux demands continuous vigilance.

Supply Chain Diversification: The Move Beyond China

The unpredictable costs have driven a major shift in global manufacturing. For many, tariff mitigation now means fundamentally rethinking where products are made. We’ve seen a clear trend towards supply chain diversification, with businesses exploring nearshoring and friend-shoring options.

This is where partners like Altraco come in. Our expertise in offshore contract manufacturing extends beyond China to countries like Mexico and Vietnam. For companies making automotive parts, sporting goods, or outdoor gear, shifting production is a strategic move to reduce the China duty impact. Mexico offers proximity and USMCA benefits, while Vietnam provides a competitive manufacturing base in Southeast Asia. We help clients manage these new manufacturing relationships, ensuring quality and efficiency for long-term supply chain resilience. For guidance on these shifts, check out A manufacturer’s guide to US tariffs.

The Latest Chapter: The October 2025 US-China Trade Deal

A new US-China trade deal announced in October 2025 brought some adjustments to the tariff landscape, offering a glimmer of hope for de-escalation.

Key Provisions of the Agreement

The deal included several provisions to reduce the immediate China duty impact. Key among them were lowering the IEEPA “fentanyl” tariff back to 10%, suspending the heightened reciprocal “Liberation Day” tariffs for one year, and extending certain Section 301 tariff exclusions until late 2026. The agreement also addressed semiconductor trade, with China agreeing to end retaliation against US manufacturers and resume the flow of critical legacy chips.

What the November 2025 Fact Sheet Reveals

A White House Fact Sheet provided more detail, highlighting commitments from both sides. China agreed to significant purchases of US agricultural products like soybeans and to remove some retaliatory tariffs on those goods. Crucially, China also committed to halting new export controls on rare earth elements and other critical minerals (like gallium and graphite) and to license exports of these materials to US end users.

For its part, the US suspended certain pending trade rules and extended specific tariff exclusions. While this deal offers some immediate relief and a framework for dialogue, the overall China duty impact remains substantial, and businesses must continue to adapt.

Frequently Asked Questions about the China Duty Impact

The complexities of US-China tariffs raise many questions for businesses. Here are answers to some of the most common inquiries regarding the China duty impact.

What is the final tariff rate on a product imported from China?

There is no single rate. The final tariff is a cumulative calculation based on “tariff stacking.” You must add the baseline Most-Favored-Nation (MFN) rate to any applicable duties, which can include:

- Section 301 Tariffs: Ranging from 7.5% to 100% depending on the product..

- Section 232 Tariffs: 25% to 50% on goods like steel, aluminum, and auto parts.

- IEEPA Tariffs: A 10% “fentanyl” tariff on most Chinese goods.

The sum of these duties is the final effective rate. It is crucial to consult official sources for the rate specific to your product’s HTS code.

How can my business reduce the impact of China tariffs?

Navigating the high China duty impact requires a multi-faceted strategy:

- Seek Tariff Exclusions: Monitor USTR announcements for product-specific exclusions that can provide significant savings.

- Diversify Your Supply Chain: This is the most effective long-term strategy. Consider alternative manufacturing locations to reduce reliance on China.

- Nearshore to Mexico: Manufacturing in Mexico offers proximity, reduced lead times, and benefits under the USMCA agreement, bypassing many China-specific tariffs.

- Offshore to Vietnam: Vietnam is a strong alternative for competitive offshore manufacturing, especially for products requiring skilled labor.

- Partner with Experts: Altraco simplifies global supply chains. We leverage our experience in tariff navigation and our factory relationships in Mexico, Vietnam, and beyond to help you mitigate costs, ensure quality, and maintain on-time delivery.

Are the current tariffs permanent?

The permanence of current tariffs is uncertain. The tariff environment is dynamic and subject to change based on trade negotiations, future policy shifts, and legal challenges. For example, the legality of IEEPA tariffs is currently being decided in federal court. Some tariffs and exclusions also have built-in expiration dates. Because of this, businesses must remain agile and continuously monitor these developments to manage the China duty impact effectively.

Conclusion: Strategic Manufacturing in a World of Tariffs

The China duty impact has made global trade more complex and unpredictable than ever. Stacked tariffs, retaliatory measures, and legal battles create a labyrinth of costs that challenge profitability for companies sourcing automotive parts, sporting goods, and home improvement items from China.

In this environment, strategic planning and expert guidance are essential. Relying on traditional sourcing is no longer sustainable; businesses must accept supply chain diversification by exploring contract manufacturing alternatives in regions like Mexico and Vietnam.

At Altraco, our mission is to simplify these complexities. Based in Thousand Oaks, CA, we use our decades of experience and trusted global factory network to build resilient, cost-effective supply chains. Whether setting up nearshoring operations in Mexico or offshoring to Vietnam, we are your partner in strategic manufacturing. We ensure quality, on-time delivery, and significant cost savings, allowing you to focus on your core business. Don’t let tariffs dictate your future—take control of your supply chain.

For more insights into managing tariffs and their impact on your California-based business, explore our guide on Navigate the complexities of tariffs in California.