Why HS Codes are Music to a Shipper’s Ears

HS code for musical instruments is primarily found in Chapter 92 of the Harmonized System, which covers “Musical Instruments; Parts and Accessories of Such Articles.” Here’s a quick reference for the most common classifications:

| Instrument Type | HS Code | Description |

|---|---|---|

| Pianos (Upright) | 9201.10 | Upright pianos |

| Pianos (Grand) | 9201.20 | Grand pianos |

| Guitars (Acoustic) | 9202.90 | Other string musical instruments |

| Electric Guitars | 9207.90 | Electrically amplified musical instruments |

| Violins | 9202.10 | Bowed string musical instruments |

| Brass Instruments | 9205 | Wind musical instruments (brass) |

| Percussion | 9206.00 | Drums, xylophones, cymbals |

| Instrument Cases | 4202.92 | Cases for musical instruments |

| Strings | 9209.30 | Musical strings |

Your HS codes determine compliance, admissibility, and potential supply chain advantages. For manufacturers shipping musical instruments internationally, these six-digit codes are the universal language customs authorities use to classify goods, calculate duties, and collect trade statistics.

Over 98% of merchandise in international trade is classified using the Harmonized System. More than 200 countries apply this system, making it essential for anyone involved in global manufacturing and distribution. The system is organized into 21 Sections and 96 Chapters, with Chapter 92 specifically dedicated to musical instruments.

While the first six digits are standardized globally, countries extend these codes to 8, 10, or even 12 digits for national tariff and statistical purposes. For example, a guitar classified as 9202.90 internationally might become 9202.90.0040 in the United States or a 12-digit code in GCC countries after January 1, 2025.

Incorrect classification isn’t a mere inconvenience. It can lead to customs delays, unexpected tariffs, shipment seizures, fines, and audits. For large enterprises with complex supply chains, precise HS code classification protects finances and creates strategic advantages.

Recent tariff developments, including ongoing trade policy shifts and Supreme Court decisions affecting U.S. tariff authority, have made accurate classification even more critical. Whether you’re manufacturing sporting goods with musical components or automotive accessories with electronic sound systems, understanding how these codes work is non-negotiable.

I’m Albert Brenner. With over 40 years of experience in international manufacturing for Fortune 500 companies, I’ve seen how mastering HS code for musical instruments prevents costly supply chain disruptions. At Altraco, our contract manufacturing business is built on expertise in countries like China, Mexico, and Vietnam, where understanding tariff codes is as crucial as quality control.

The Foundation: Understanding Chapter 92 and the Harmonized System

When we talk about the HS code for musical instruments, we’re primarily looking at Chapter 92 of the Harmonized System. This dedicated section within a global classification system acts as a universal economic language for international trade.

The World Customs Organization (WCO) in Brussels, Belgium, oversees this intricate system. As the global authority on customs, the WCO’s role in maintaining and updating the Harmonized System is paramount. The HS is structured logically with General Rules of Interpretation (GRI) to ensure consistent classification. This consistency is vital for determining customs duties and collecting trade statistics that inform global economic policies.

We encourage you to dig deeper into the system’s fundamentals by exploring the WCO’s own overview: What is the Harmonized System?.

What is HS Chapter 92?

Chapter 92 is where musical instruments find their home within the Harmonized System, covering “Musical Instruments; Parts and Accessories of Such Articles.” This includes everything from grand pianos to harmonicas.

However, not everything used with an instrument falls under Chapter 92. Key exclusions include:

- Toy Instruments: Instruments designed for children’s play, not serious musical performance, are classified as toys under heading 9503.

- Collectors’ Pieces or Antiques: Very old or rare instruments traded as collectors’ items may fall under headings 9705 or 9706.

- Parts of General Use: Items like generic screws made of base metal or plastic are excluded, as they have general applications beyond musical instruments.

- Electronic Accessories: External components like microphones, amplifiers, and headphones are classified separately, typically in Chapter 85 (electrical machinery) or Chapter 90.

- Bows and Sticks: Bows and drumsticks imported with their corresponding instrument in normal quantities are classified with the instrument.

- Cards, Discs, and Rolls: Items like piano rolls are treated as separate articles and classified under heading 9209, even when imported with an instrument.

Understanding these nuances is crucial, as misclassifying an accessory can lead to significant costs.

The Role of the World Customs Organization (WCO)

The Harmonized System is the product of continuous effort by the World Customs Organization (WCO). As the global custodian of the HS, the WCO is responsible for:

- HS Maintenance and Updates: The WCO ensures the system remains relevant, with updates every 5-6 years to reflect new technologies and trade patterns (last updated in 2022).

- Explanatory Notes: The WCO publishes detailed Explanatory Notes, the definitive legal texts for interpreting HS nomenclature.

- Global Standardization: The Harmonized System Committee works to ensure uniform application of the HS across its 200+ member countries, reducing trade barriers.

For businesses managing complex supply chains in China, Mexico, and Vietnam, staying current with WCO decisions is fundamental. The WCO’s online resources, like the WCO Trade Tools, are invaluable for accurate classification.

Decoding the Digits: Your Guide to the HS Code for Musical Instruments

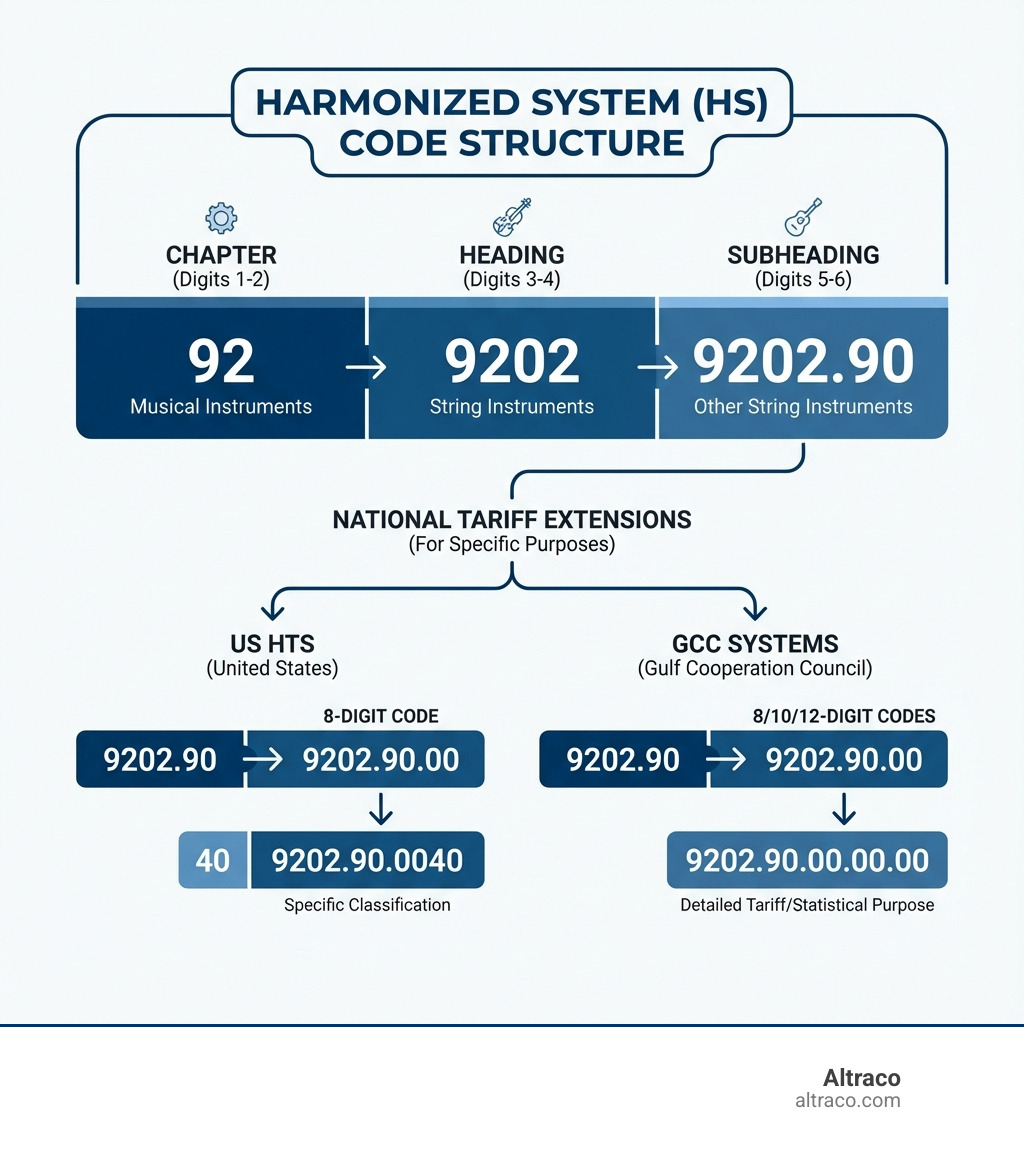

The Harmonized System is a hierarchical structure, starting broad and getting more specific with each pair of digits.

The core of the system is the 6-digit international standard, which defines a product globally. For instance, “9202.90” is universally recognized as “Other string musical instruments.”

Individual countries extend this code to 8, 10, or even 12 digits for national purposes, such as:

- Tariff Suffixes: To specify different tariff rates based on product details or trade agreements.

- Statistical Suffixes: To collect more detailed trade data.

This means an acoustic guitar’s full national code might be 9202.90.0040 in the United States but something different in Mexico or Vietnam.

From Global HS to National HTS: What’s the Difference?

A critical distinction exists between the global Harmonized System (HS) and national tariff schedules like the US Harmonized Tariff Schedule (HTS).

- Harmonized System (HS): The international 6-digit nomenclature from the WCO, providing a common foundation for global classification.

- Harmonized Tariff Schedule (HTS): A country-specific implementation. The US HTS extends the 6-digit HS code to 10 digits for imports. The EU uses a similar system called TARIC.

These country-specific variations mean a product’s full tariff code differs by destination. Operating from California and managing manufacturing globally, we help clients steer the nuances of the US HTS and other national systems to ensure compliance.

Navigating these differences is a core part of effective global supply chain management. Our guide on Understanding Manufacturing Terminology in the Global Supply Chain provides further insights.

How Instrument Features Affect the HS code for musical instruments

An instrument’s specific characteristics are crucial for determining its HS code.

- Electric vs. Acoustic: This is a key distinction. An acoustic guitar (9202.90) produces sound mechanically, while an electric guitar (9207.90) requires electrical amplification. This principle applies to other instruments like organs.

- Material Composition: Materials can trigger other regulations. For example, instruments with certain woods (e.g., rosewood) may be subject to CITES regulations for endangered species.

- Pianos by Size: Pianos are classified by type: uprights (9201.10) and grands (9201.20). Customs may require specific measurements for statistical purposes, highlighting the need for precision.

- Guitars, Wind Instruments, Percussion: Each category has a specific heading. Violins are 9202.10, brass instruments are under 9205, and percussion is in 9206.00.

- Hybrid Instruments: Classifying instruments that blend acoustic and electronic elements can be complex. It requires applying the General Rules of Interpretation to determine the “essential character.”

The more specific you are about an instrument’s features, the easier it is to find the correct HS code.

A Practical Guide: Key HS Codes for Instruments and Accessories

Let’s put theory into practice with some common examples to get a better feel for how the Harmonized System works for musical instruments.

| Instrument Type | HS Code (6-digit) | Description | Key Feature |

|---|---|---|---|

| Pianos (Upright) | 9201.10 | Upright pianos | Acoustic, vertical string arrangement |

| Pianos (Grand) | 9201.20 | Grand pianos | Acoustic, horizontal string arrangement |

| Guitars (Acoustic) | 9202.90 | Other string musical instruments | Acoustic, non-bowed |

| Electric Guitars | 9207.90 | Electrically amplified instruments | Sound produced/amplified electrically |

| Violins | 9202.10 | Bowed string musical instruments | Acoustic, played with a bow |

| Trumpets/Trombones | 9205 | Wind musical instruments (brass) | Brass construction, played by blowing |

| Drums | 9206.00 | Percussion musical instruments | Played by striking, includes xylophones, cymbals |

| Accordions (electric) | 9207.90 | Electrically amplified instruments | Sound produced/amplified electrically |

Finding the HS code for musical instruments

Finding the correct HS code for musical instruments requires a systematic approach:

- Identify the Instrument Category: Start by determining if it’s a piano (9201), string instrument (9202), wind instrument (9205), or percussion instrument (9206).

- Check for Electrical Amplification: If the sound is produced or must be amplified electrically, it likely belongs in heading 9207 (e.g., electric guitars). This is a critical distinction.

- Refine the Subheading: Use subheadings to get more specific. For example, under string instruments (9202), bowed instruments are 9202.10, while others like guitars are 9202.90.

- Consult Official Resources: Always verify the 6-digit code with WCO Explanatory Notes and find the full national code using official tools like the U.S. Harmonized Tariff Schedule (HTS) for US imports.

Classifying Parts and Accessories: A Common Pitfall

Many businesses stumble when classifying parts and accessories. It’s a common pitfall to assume everything belongs in Chapter 92. The HS classifies many items based on their own function or material, placing them in different chapters.

Common examples include:

- Instrument Cases: Classified as containers under heading 4202.92.

- Strings: Have their own specific heading, 9209.30.

- Amplifiers and Microphones: Classified as electronic devices under heading 8518.

- Stands: Classified as furniture under heading 9403.

- Batteries: Classified under heading 8507.

The key is to classify the item itself, not its association with an instrument. This complexity is why specialized Why International Sourcing Services Are Critical for Modern Manufacturing are so valuable. At Altraco, we accurately classify every component, whether for musical instruments or automotive parts.

The 2025 Overture: Upcoming HS Code Changes and Their Impact

The world of HS codes is constantly evolving, with significant changes in 2025 impacting international trade and e-commerce. These shifts affect trade finance, customs clearance, and supply chain strategy.

The growth of cross-border e-commerce has increased scrutiny on all shipments, including low-value ones. Even small packages now require precise HS code classification. For businesses manufacturing in China, Mexico, and Vietnam, staying ahead of these changes is crucial for seamless logistics. Our Integrated Supply Chain Services are designed to steer these evolving landscapes.

GCC’s 12-Digit System and the USA’s HTS Mandate

Two major regional changes in 2025 will affect musical instrument shipments:

- GCC’s 12-Digit System: From January 1, 2025, the Gulf Cooperation Council (GCC) countries will mandate a 12-digit HS code system. Shipments to the UAE, Saudi Arabia, and other GCC nations will require this extended code.

- USA’s HTS Mandate for USPS: Starting September 1, 2025, all shipments entering the US via the U.S. Postal Service (USPS) will require a full 10-digit HTS code. This change significantly impacts e-commerce and low-value shipments, which previously had less stringent data requirements.

These changes underscore the global move towards greater data accuracy in trade. For our clients manufacturing home improvement, sporting goods, or automotive parts that might include musical components, these updates mean a renewed focus on precise classification.

Navigating CITES and Other Regulations

Beyond HS codes, musical instruments are subject to other critical regulations like CITES.

- CITES Regulations: The Convention on International Trade in Endangered Species (CITES) protects wildlife by regulating trade. This affects instruments made from materials like certain rosewoods or ebony. For example, instruments with CITES-listed materials require special permits for import/export, and failure to comply can result in confiscation.

- Other Controls: Instruments may also be subject to regional luxury goods controls, which can impose extra duties or taxes. Additionally, countries may have their own import/export controls for reasons of cultural heritage or national security.

Navigating these layers of regulation, from the primary HS code for musical instruments to CITES permits, requires expertise. At Altraco, we work with our partners and customs brokers to ensure all necessary documentation is in place, providing peace of mind for our clients.

Frequently Asked Questions about Musical Instrument HS Codes

Here are some common questions to help you hit the right note with your classifications.

What is the primary HS code for a guitar?

The primary HS code depends on the guitar’s type:

- Acoustic guitars fall under 9202.90 (“Other string musical instruments”). Their sound is produced mechanically.

- Electric guitars fall under 9207.90, as their sound must be electrically amplified.

The full 8- or 10-digit national code will vary by country. For example, the US HTS code for an acoustic guitar might be 9202.90.0040. Always check the destination country’s tariff schedule.

How do I find the correct HS code for a musical instrument part?

Classifying parts is often complex as many fall outside Chapter 92. The key is to identify the part’s primary function or material, consulting the official notes for exclusions.

- Instrument cases: Chapter 42 (heading 4202.92)

- Musical strings: Chapter 92 (subheading 9209.30)

- Amplifiers/Microphones: Chapter 85 (heading 8518)

- Instrument stands: Chapter 94 (heading 9403)

- Batteries: Chapter 85 (heading 8507)

When in doubt, consult official customs resources or an expert.

What happens if I use the wrong HS code?

Using an incorrect HS code can cause significant problems:

- Customs Delays: Misclassified goods are often held for investigation.

- Unexpected Tariffs and Fines: You may face higher duties than expected, back-duties, and substantial financial penalties.

- Shipment Seizures: In severe cases, customs can seize your goods.

- Audits: Repeated errors can trigger time-consuming customs audits.

Accurate classification is a legal responsibility that ensures smooth trade, protects your finances, and safeguards your reputation.

Conclusion: Harmonize Your Supply Chain with Expert Guidance

Mastering HS codes for musical instruments, their parts, and accessories is critical for successful international trade. Understanding Chapter 92, key distinctions like electric vs. acoustic, and upcoming 2025 changes is essential for efficient tariff navigation, cost savings, and supply chain efficiency.

At Altraco, our experience as an offshore contract manufacturing partner has shown that true expertise means simplifying the entire process, including customs compliance. We leverage our factory relationships in China, Mexico, and Vietnam and our deep understanding of trade regulations to ensure your products—from home improvement goods to automotive parts—arrive without costly delays.

Our California-based team guides businesses through these complexities. Partner with us to handle customs compliance, from the initial HS code for musical instruments to final delivery, so you can focus on your core business.

Ready to simplify your supply chain? Explore our guide to Outsourced Manufacturing and Navigating U.S. Tariffs and let us help your international trade play a harmonious tune.