Understanding Tariffs: What They Are and Why They Matter

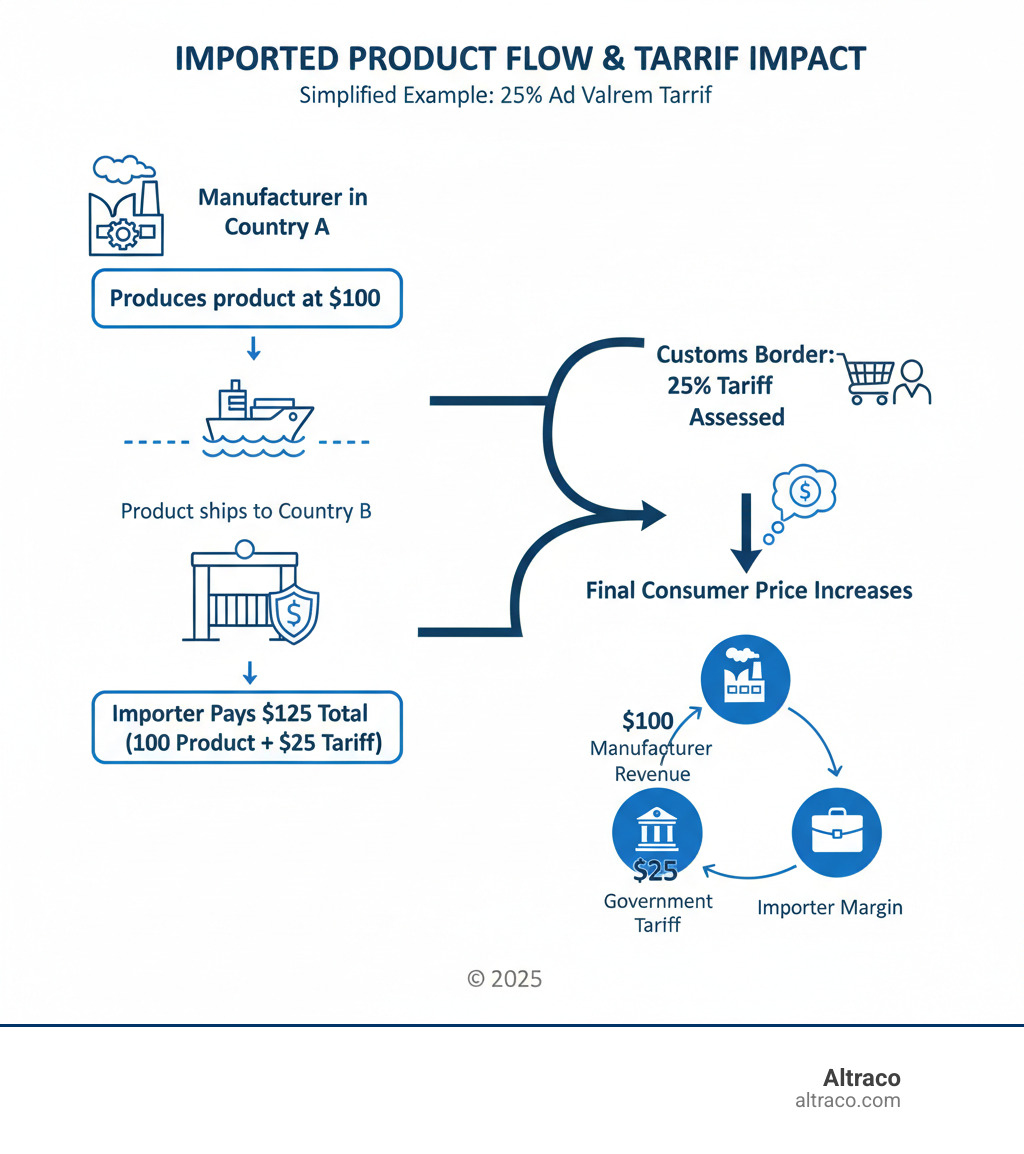

A tariff is a tax imposed by a government on imported goods, paid by the importer when products cross international borders. These taxes can be a fixed amount or a percentage of the product’s value and serve multiple purposes, from generating revenue to protecting domestic industries.

For any business manufacturing products overseas, tariffs can dramatically impact costs and supply chain strategy. The importer typically pays the tariff, but these costs are often passed on to consumers, raising prices. The 2025 tariff landscape has become particularly complex, with rates on products like steel, aluminum, and automobiles reaching levels not seen in over a century.

For businesses importing home improvement products, sporting goods, or automotive parts, understanding tariffs is essential for maintaining competitive pricing and healthy profit margins. The challenge isn’t just knowing today’s rates—it’s building a flexible supply chain that can adapt as trade policies shift.

This guide breaks down what tariffs are, their economic impact, and how your business can strategically steer them. I’m Albert Brenner, and for 40 years at Altraco, I’ve helped Fortune 500 companies manage tariff challenges by establishing successful manufacturing in countries like China, Vietnam, and Mexico. We’ve developed proven strategies to maintain quality and cost-efficiency, regardless of the trade climate.

What is a Tariff and How Is It Imposed?

When a shipping container arrives at a port, customs authorities step in to assess and collect tariffs. At its simplest, a tariff is a tax a government charges on goods crossing its borders—usually imports. Customs officers review shipping documents, verify the contents, and calculate the duties owed before products can enter the domestic market.

This process is systematic. Every traded product is classified using a Harmonized System (HS) code—a standardized international number that identifies exactly what’s being imported. For example, a basic bicycle and an electric bicycle have different HS codes and will likely face different tariff rates. Once customs determines the HS code, they find the applicable rate in the country’s tariff schedule. As the importer, you are typically responsible for paying these duties, so they must be factored into your landed cost calculations.

The Purpose and Types of Tariffs

Governments impose tariffs for several reasons. Historically, revenue generation was the primary driver. Today, protectionism is more common; by making imported goods more expensive, tariffs give domestic products a price advantage to protect local industries and jobs. Other motivations include national security, to reduce dependence on foreign suppliers for critical goods, and retaliation in trade disputes, where countries impose reciprocal duties.

Tariffs also come in several forms:

- Ad valorem tariffs are the most common, calculated as a percentage of the imported product’s value (e.g., a 10% tariff on a $100,000 shipment is $10,000).

- Specific tariffs are a fixed fee per unit, regardless of value (e.g., $10 per imported bicycle).

- Compound tariffs combine both ad valorem and specific duties.

- Tariff-rate quotas (TRQs) apply a lower tariff rate for a certain quantity of imports and a higher rate for quantities exceeding that quota.

While less common, export tariffs are taxes on goods leaving a country. Understanding which type of tariff applies to your products is essential for accurate cost modeling. For more context on these mechanisms, see The Basics Of Tariffs and Trade Barriers. At Altraco, we help clients decode these complexities to minimize duty costs while maintaining quality and reliability.

The Economic Effects of Tariffs

When governments impose tariffs, they set off a chain reaction that affects domestic industries, consumers, and the broader economy. For businesses with offshore manufacturing—whether producing sporting goods in Vietnam or automotive parts in Mexico—understanding these effects is critical for maintaining healthy margins.

How Tariffs Impact Producers and Consumers

The most immediate effect of a tariff is a higher price for consumers. Importers and retailers rarely absorb the full cost of a duty, instead passing it on to shoppers. This makes domestic alternatives more price-competitive, but it comes at a cost to consumers, who pay more or have fewer choices.

Domestic manufacturers also face challenges. If they rely on imported materials, such as specialized steel or electronic components, tariffs on those inputs squeeze their margins. They are caught between raising prices or accepting lower profits.

On the other hand, domestic producers competing with the final imported good can benefit. Tariffs can shield them from foreign competition, potentially allowing them to expand production and hire more workers. However, this protection can reduce consumer choice, as some imported products may disappear from the market.

The Broader Economic Consequences

Beyond individual prices, tariffs create what economists call deadweight loss—economic value that vanishes because a trade that would have benefited both a buyer and a seller is prevented. This inefficiency can harm the economy over time.

When domestic industries are shielded from competition, they may have less incentive to innovate or improve productivity. A comprehensive study on the macroeconomic effects of tariffs found that countries raising tariffs often experience long-term drops in economic output and productivity.

Furthermore, tariffs often provoke retaliation. Trading partners respond with their own duties, leading to trade wars that disrupt supply chains and create widespread business uncertainty. The impact on jobs is also complex; while some jobs may be saved in protected industries, others may be lost in sectors that use imported goods or are targeted by retaliatory tariffs. These economic ripples are the daily reality for businesses managing global supply chains.

The Enduring Debate: Arguments For and Against Tariffs

Few economic topics spark as much debate as tariffs. The discussion pits protectionism against free trade, and for businesses that manufacture products overseas in sectors like home improvement, sporting goods, and automotive parts, the outcome of this debate directly shapes their supply chain strategies.

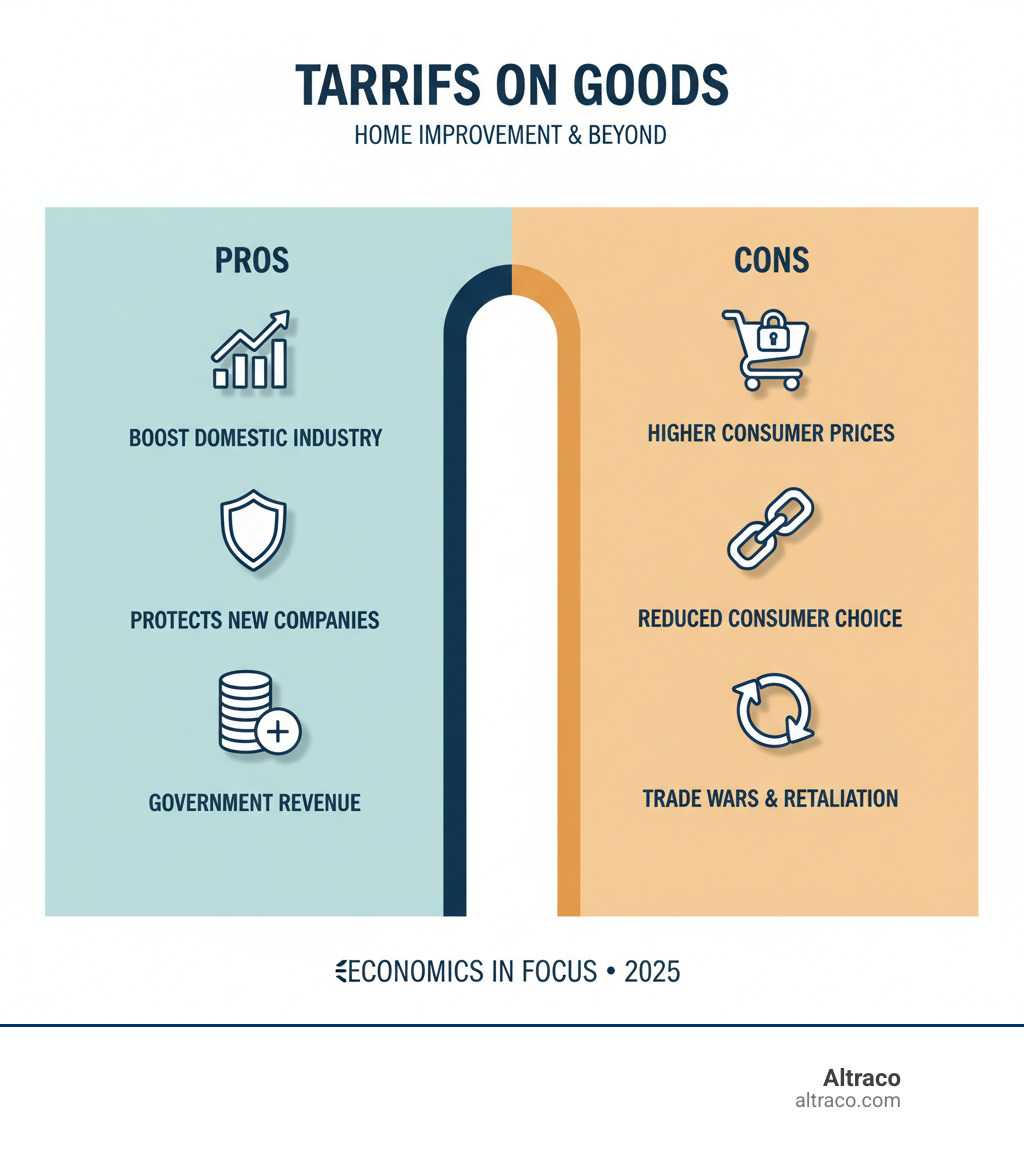

The Case for Imposing Tariffs

Proponents of tariffs make several key arguments. The infant industry argument suggests that new domestic industries need temporary protection from established foreign competitors to grow. Anti-dumping measures are used to counteract foreign companies selling products below cost to unfairly capture market share. The most politically resonant argument is protecting domestic jobs in industries facing steep foreign competition.

Other justifications include national security, which aims to ensure a country doesn’t depend on foreign sources for critical materials, and simple government revenue generation. While economists often question the efficiency of these measures, the arguments hold significant political appeal.

The Case Against Tariffs and for Free Trade

Conversely, economists almost universally argue against tariffs. The primary drawback is higher costs for consumers, as duties on imported goods are passed on in the final price. Tariffs also create market distortion and inefficiency, as protected domestic companies have less incentive to innovate or improve. This lack of competitive pressure can lead to stifled innovation across an industry.

Perhaps the most significant risk is retaliation and trade wars. When one country imposes tariffs, trading partners often respond in kind, disrupting global trade and harming industries on all sides. The consensus among economists is remarkably strong; they argue that the long-term economic damage from tariffs far outweighs any short-term benefits. As explored in Economists Actually Agree on This: The Wisdom of Free Trade, the evidence overwhelmingly supports the idea that free trade leads to greater prosperity.

A History of Tariffs and Modern Trade Disputes

Understanding the history of tariffs helps explain today’s trade landscape. The pattern of protectionism versus free trade has repeated for centuries, offering lessons for businesses managing global supply chains in home improvement, sporting goods, and automotive parts.

Tariffs Throughout History

Tariffs have existed for millennia, first as a simple way for governments to raise revenue. Over time, they evolved into tools of economic policy. Britain’s 19th-century Corn Laws, which placed heavy tariffs on imported grain, became a famous example of protectionism benefiting landowners at the expense of the general population. In the U.S., tariffs were the main source of federal revenue until the Civil War, after which they became primarily protectionist.

The most cautionary tale is the Smoot-Hawley Tariff Act of 1930. By raising U.S. tariffs to historic highs, the act triggered a wave of international retaliation that caused global trade to collapse. Many economists believe it worsened the Great Depression, a story detailed in NPR’s piece, A classic economics horror story. The disaster of Smoot-Hawley led to a post-WWII consensus favoring trade liberalization.

Tariffs in the 21st Century: FTAs and Trade Wars

The modern era is defined by a conflict between trade liberalization and renewed protectionism. On one hand, Free Trade Agreements (FTAs) like the Canada-United States-Mexico Agreement (CUSMA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) have eliminated or reduced tariffs among member nations.

On the other hand, recent years have seen a resurgence of trade conflicts, most notably the US-China trade war. The 2025 trade landscape has been marked by a dramatic wave of U.S. tariffs, including significant duties on steel, aluminum, automobiles, and a wide range of goods from key trading partners. For example, the U.S. imposed global tariffs of up to 50% on steel and aluminum and 25% on automobiles, while many goods from Canada faced rates as high as 35%. The duty-free de minimis exception for shipments under $800 was also suspended for many commercial imports, adding costs to smaller shipments.

In response, countries have implemented their own measures, such as the United States Surtax Remission Order (2025) from Canada, designed to relieve its manufacturers. You can find details on Canada’s response to U.S. tariffs. The World Trade Organization (WTO) continues to serve as a forum for resolving these disputes, but the environment remains volatile, requiring businesses to stay agile.

How Businesses Can Steer the Complex World of Tariffs

For businesses manufacturing home improvement, sporting goods, or automotive parts overseas, navigating tariffs is essential for protecting margins and staying competitive. With the right strategy and expert guidance, you can mitigate tariff risks and strengthen your supply chain.

Essential Resources and Tools

An informed business is a prepared business. Key resources include the importing country’s customs agency, which is the final authority on rates and classifications. For imports into the U.S., the U.S. International Trade Commission Tariff Database is indispensable. For Canadian exporters, the Canada Tariff Finder is a valuable tool. The World Trade Organization also provides comprehensive tariff data. At Altraco, we offer specialized guides like our Manufacturers Guide: United States Tariffs and a tracker for Current China Tariffs to help our clients stay ahead.

Strategic Approaches to Mitigate Tariff Costs

Knowing the tariffs is the first step; having a strategy to address them is what creates a resilient business.

- Supply Chain Diversification: Spreading production across multiple countries like China, Vietnam, and Mexico creates flexibility. If tariffs spike in one region, you can shift production to another without major disruption.

- Nearshoring to Mexico: For U.S. companies, manufacturing in Mexico offers logistical benefits and allows you to leverage the CUSMA agreement, which can eliminate tariffs on qualifying goods. This is especially effective for automotive parts and home improvement products.

- Offshoring to Vietnam: As an alternative to China, Vietnam often provides favorable labor costs and different trade agreements, which can result in lower tariff exposure for products like sporting goods and outdoor equipment.

- Tariff Engineering and Exclusions: This involves designing a product to fall under an HS code with a lower tariff rate. It requires deep customs knowledge but can yield significant savings. Applying for tariff exclusions on specific products is another option, though the process can be complex.

Working with experts who understand the Complexities of Tariffs is invaluable. A partner like Altraco or a knowledgeable U.S. customs broker can help you Navigate Section 301 Tariffs and implement these strategies effectively.

Conclusion

We’ve explored what a tariff is, its economic impact, and the historical context that shapes today’s trade policies. The key takeaway is that tariffs are a persistent reality of global business. The 2025 trade environment, with its high duties on everything from automotive parts to steel, has made navigating these costs more critical than ever.

However, tariffs are a manageable challenge, not an impossible roadblock. The solution lies in building a flexible and strategic supply chain. By diversifying your manufacturing base across countries like Mexico, Vietnam, and China, and understanding the nuances of trade agreements like CUSMA, you can protect your business from volatility.

At Altraco, we have spent four decades helping companies in the home improvement, sporting goods, and automotive industries turn these challenges into opportunities. Our global network of trusted factories gives you options, and our expertise in navigating the tariff landscape ensures you can maintain a competitive edge.

We handle the complexity of offshore manufacturing—from HS code verification to supply chain diversification—so you can focus on growing your business. To learn how we can help you optimize your manufacturing strategy and turn tariff challenges into advantages, visit our offshore manufacturing services page.