Why Trade Compliance Audits Matter for Your Business

A trade compliance audit is a structured examination conducted by government agencies like U.S. Customs and Border Protection (CBP) or the Canada Border Services Agency (CBSA) to verify that importers and exporters accurately report their shipments and comply with all applicable trade laws and regulations. These audits assess critical areas including tariff classification, customs valuation, country of origin, and trade agreement qualifications.

Quick Answer: Key Facts About Trade Compliance Audits

- What it is: A government review of your import/export records, classification accuracy, and duty payments

- Who conducts them: CBP (U.S.), CBSA (Canada), or internal audit teams

- What they review: Tariff codes, customs values, origin declarations, trade agreement claims, and supporting documentation

- Why they matter: Non-compliance can result in substantial penalties, back-duties, shipment seizures, and personal liability

- How to prepare: Maintain organized records for 5+ years, conduct regular self-audits, and implement strong internal controls

Imagine this scenario: A customs enforcement officer arrives at your office unannounced, requesting bills of lading and duty payment receipts from three years ago. Your team scrambles through unlabeled boxes, unsure where to find the documents. If you cannot produce the requested documentation during a trade compliance audit, you are going to incur penalties, fines, and even harsher punishments.

For companies manufacturing overseas—whether in Mexico, China, Vietnam, or other countries—the stakes are particularly high. Recent shifts in tariff policy, including Supreme Court decisions affecting tariff enforcement, have intensified government scrutiny of cross-border supply chains. CBSA audit data reveals non-compliance rates ranging from 33% to 100% across different product categories, with assessed duties and penalties reaching into the millions of dollars.

The complexity grows when you consider the Harmonized Tariff System (HTS) classification, free trade agreement qualifications like CUSMA, customs valuation rules, and country of origin requirements. A single misclassification can cascade across thousands of shipments, triggering substantial back-duty assessments.

Yet many importers only find gaps in their compliance programs when they receive an audit notification—and by then, it’s often too late to avoid consequences. The good news? With proper preparation, robust internal controls, and strategic partnerships, you can steer audits confidently while protecting your bottom line.

I’m Albert Brenner, and over 40 years of co-owning a contract manufacturing company, I’ve guided Fortune 500 clients through countless trade compliance audits while manufacturing home improvement, sporting goods, automotive parts, and outdoor products across multiple countries. Through Altraco, we’ve built resilient supply chains that withstand regulatory scrutiny while delivering quality and cost efficiency.

What is a Trade Compliance Audit and Why is it Crucial?

A trade compliance audit is essentially a deep dive into your company’s international trade activities. It’s a review of your current internal and external communications, processes, and actions in international trade, all to ensure adherence to regulatory measures. At its core, a trade compliance audit aims to verify that we, as importers and exporters, meet all the rules and regulations governing the movement of commercial goods into and from a country. This includes accurately reporting shipment information, classifying goods correctly, declaring their true value and origin, and paying the appropriate duties and taxes.

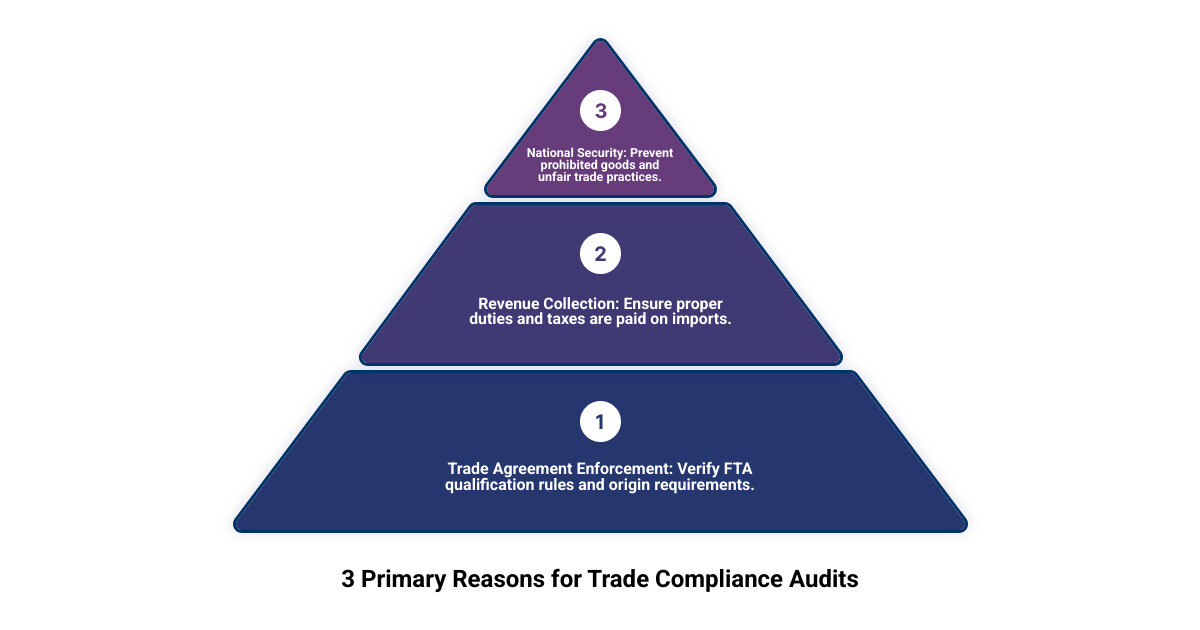

The purpose of these audits is multifaceted and crucial for both governments and businesses. For government agencies like U.S. Customs and Border Protection (CBP) or the Canada Border Services Agency (CBSA), audits serve to protect government revenue by ensuring proper duties are collected. They also enforce trade laws, deter future violators, protect domestic industries from unfair trade practices, and facilitate legitimate trade. They contribute to national security by preventing the entry of prohibited goods.

As the Importer of Record, the responsibility for accurate reporting falls squarely on our shoulders. This means ensuring that every detail of our imports, from the tariff code to the country of origin, is correct. The complexities of tariffs alone can be daunting, as we explore in depth in our guide, The Complexities of Tariffs.

Who Conducts Audits?

Trade compliance audits can be conducted by various entities, both governmental and internal:

- Government Agencies: These are the primary external auditors. In the United States, this includes agencies like U.S. Customs and Border Protection (CBP) through their Trade Regulatory Audit (TRA) division. They collaborate with other bodies such as U.S. Immigration and Customs Enforcement (ICE) and Homeland Security Investigations (HSI). In Canada, the Canada Border Services Agency (CBSA) is responsible for ensuring compliance. Additionally, the Office of Export Enforcement plays a significant role in export compliance.

- Internal Audit Teams: Many businesses, especially those with significant international trade operations, conduct their own internal audits. This proactive approach helps identify and rectify issues before external agencies come knocking. However, it’s important to be aware that internal audits can sometimes be biased, leading staff to inadvertently downplay potential violations.

- Third-Party Auditors: To gain an unbiased, external perspective for internal audits, some companies engage third-party logistics providers or specialized consulting firms. This can provide a fresh set of eyes and help ensure a more objective assessment of compliance.

Why Audits are on the Rise

We’ve observed a steady increase in customs audits in recent years, and for good reason. The landscape of global trade is constantly evolving, driven by several key factors:

- Increased Global Trade: As more businesses engage in international commerce, the volume and complexity of cross-border transactions naturally grow, requiring greater oversight.

- Complex Trade Agreements: The proliferation of trade agreements, such as CETA and CUKTCA, each with its own intricate rules of origin and compliance requirements, adds layers of complexity that agencies must verify.

- Shifting Tariff Landscapes: We’ve seen significant shifts in tariff policies, including recent United States Supreme Court decisions that have impacted tariff enforcement. These changes, alongside fluctuating rates like the Current China Tariffs, necessitate increased vigilance from both businesses and regulators. Our expertise in navigating tariffs, especially for manufacturing in China, Mexico, and Vietnam, has become invaluable for our clients.

- Focus on Enforcement: Government agencies are increasingly prioritizing trade enforcement. They are employing sophisticated data analysis and risk assessment procedures to identify areas of potential non-compliance and target specific products or companies for audits. The CBSA, for instance, uses a risk-based, evergreen process to determine its verification priorities, adding new targets throughout the year. This targeted approach means that if your goods fall into a high-risk category, your chances of an audit increase significantly.

The Anatomy of an Audit: Key Areas and Required Documentation

When it comes to trade compliance, the “reasonable care” standard is paramount. This means we, as importers, are expected to exercise due diligence in ensuring the accuracy of our import declarations. A critical aspect of demonstrating reasonable care is meticulous record-keeping. We must maintain accurate records for an extended period, often a five-year retention rule, to support every claim made on our import and export documents. If we can’t produce these records, even years later, it can lead to significant penalties.

Key Components of a Trade Compliance Audit

During a trade compliance audit, agencies will scrutinize several key areas of our operations:

- Tariff Classification (HS/HTS Codes): This is often one of the most critical and frequently audited areas. Correct Harmonized System (HS) or Harmonized Tariff Schedule (HTS) classification determines the duty rate, any applicable quotas, and other regulatory requirements for our goods. Misclassification can lead to duty overpayment or, more critically, underpayment and subsequent penalties. For instance, CBSA audits have revealed numerous cases of misclassification, such as:

- Automotive lighting assemblies misclassified as simple lamps, avoiding higher duties.

- Multi-function power tools incorrectly classified as simple drills.

- LED lamps misclassified under duty-free items.

- Finished sporting goods (like a complete bicycle) misclassified as individual parts (like bicycle parts in Heading 87.14) to attract a lower duty rate.

- Outdoor patio heaters misclassified as industrial equipment.

These examples highlight how even seemingly minor classification errors can result in substantial financial liabilities.

- Customs Valuation: Auditors will examine how we determine the value of imported goods for duty purposes. This can be particularly complex, especially with cross-border transactions involving related parties or unique transaction structures. The World Customs Organization (WCO) emphasizes that Post-Clearance Audits (PCA) are essential for ensuring Customs controls are effective, particularly concerning the WTO Customs Valuation Agreement.

- Country of Origin (COO): Accurately declaring the country of origin is vital for many reasons, including duty assessment, trade statistics, and compliance with marking requirements. We’ve seen cases where manufacturers declare goods as “Made in USA” to qualify for NAFTA, despite using key components sourced from non-qualifying countries, leading to non-compliance findings. Companies often need to obtain specific Country of Origin Certificates to support their declarations.

- Free Trade Agreement (FTA) Qualification: If we claim preferential tariff treatment under FTAs like CUSMA (the updated NAFTA), CETA, or CUKTCA, auditors will verify that our goods meet the specific rules of origin for those agreements. The CBSA, for example, conducts verifications on the origin of assembled goods like power tools, focusing on whether the motors and electronic components used qualify under trade agreements. Our experience has shown that some products verified did not qualify under NAFTA/CUSMA because of the inputs used in their production. Understanding these intricate rules is key to leveraging FTAs effectively, as detailed in our Manufacturers Guide to United States Tariffs.

Essential Documentation Checklist

Preparing for an audit means having a robust documentation system. Here’s a checklist of documents typically required:

- Commercial Invoices

- Packing Lists

- Bills of Lading (or Airwaybills for air freight)

- Purchase Orders

- Proof of Payment (e.g., bank statements, wire transfer records)

- Certificates of Origin (if claiming preferential treatment)

- Import/Export Declarations (Customs entries)

- Licenses and Permits (if applicable for regulated goods)

- Manufacturing Cost Sheets (especially for valuation or origin audits)

- Communication records with suppliers and customers

- Internal policies and procedures related to import/export

Navigating the Trade Compliance Audit Process: Types and Preparation

Receiving an audit notification can certainly make your heart sink. But with a clear understanding of the process and proper preparation, it doesn’t have to be a nightmare. The initial contact typically involves a formal letter or communication from the auditing agency, outlining their intent and the scope of the audit. Our first piece of advice is always: don’t panic, but don’t delay. Immediately contact a trade compliance expert for advice on how to proceed.

Types of Audits

Audits aren’t one-size-fits-all. They come in various forms, each with its own focus and methodology:

- Internal vs. External Audits:

- Internal Audits: These are self-initiated reviews conducted by a company’s own team or a hired third party. Their purpose is to proactively identify weaknesses and ensure compliance before external agencies intervene. While crucial, as mentioned, internal audits can sometimes suffer from bias. Utilizing a third-party logistics provider can offer an objective perspective.

- External Audits: These are conducted by government agencies. They can be triggered randomly or targeted based on risk assessments.

- Random vs. Targeted Verifications:

- Random Audits: Less common, these might be part of a broader program to gauge overall compliance levels.

- Targeted Verifications: Most audits fall into this category. Agencies use a risk-based approach, often focusing on specific commodities or industries known for non-compliance. For example, the CBSA identifies specific commodities for audit in January and July each year, focusing on areas like tariff classification, validation of values, origins, or free trade certification.

- CBP’s Focused Assessment (FA) Program: This is a comprehensive audit conducted by U.S. Customs and Border Protection. It assesses an importer’s internal controls over its import activities to determine if the importer poses an acceptable risk for complying with CBP laws and regulations. The FA program typically involves three phases: a Pre-Assessment Survey (PAS), Assessment Compliance Testing (ACT), and a Follow-Up Audit.

- Post-Clearance Audits (PCA): As the name suggests, a PCA is a structured examination conducted after Customs has released the cargo. It involves reviewing commercial data, sales contracts, financial and non-financial records, physical stock, and other assets. The WCO highlights PCAs as a crucial instrument for consolidating a multi-layered risk management approach, motivating traders towards full compliance.

- CBSA Compliance Validation Letters (CVL): The CBSA employs a range of compliance intervention tools. A CVL is a letter asking the importer for more information when the CBSA suspects non-compliance. Importers must respond within 30 days, and a monetary assessment might follow. Other tools include Trade Advisory Notices (TANs), which are less formal and offer guidance, and Directed Compliance Letters (DCLs), which accompany monetary assessments for known non-compliance.

How to Prepare for an Audit

Preparation is our best defense. Here’s how we advise businesses to get ready:

- Assemble an Audit Team: Designate key personnel from relevant departments (e.g., logistics, finance, legal) to form an internal audit response team.

- Designate a Point of Contact: Assign a single, knowledgeable individual to be the primary liaison with auditors. This streamlines communication and prevents conflicting information.

- Conduct Self-Audits: Regularly review your own import and export processes. This includes organizational policies and procedures, documentation practices, licensing, and duty payments. Utilizing tools like the EMCP Audit Module for export management compliance can be incredibly helpful for systematically assessing your program.

- Review Internal Controls: Strong internal controls are the backbone of compliance. Auditors will often assess the design of your internal controls over CBP compliance. Ensure your processes for classification, valuation, origin determination, and record-keeping are robust and consistently followed. This ties directly into our commitment to quality, as reflected in our efforts to Maintain Quality Control Program across all manufacturing processes.

- Organize Documentation: This cannot be stressed enough. The scenario of scrambling through unlabeled boxes is a real one. Maintain clear, accessible, and well-organized records. Digital archiving with proper indexing can be a lifesaver. Ensure you can quickly retrieve commercial invoices, bills of lading, certificates of origin, and all other required documents.

The High Stakes of Non-Compliance and How to Mitigate Risk

The consequences of failing a trade compliance audit are severe and can have a devastating impact on a business. The research clearly shows that non-compliance is rampant, and the penalties are substantial.

Let’s look at some revealing statistics from CBSA audits:

- Automotive Parts: Non-compliance rates ranged from 40% to 85%, with duties assessed totaling over $3.1 million and penalties exceeding $80,000.

- Power Tools: Non-compliance reached 70% to 90%, resulting in over $4 million in assessed duties and $115,000 in penalties.

- LED Lamps (Rounds 1-2): Non-compliance was incredibly high (81-92%), leading to over $3.6 million in assessed duties and $96,600 in penalties.

- Bicycle Parts (Rounds 1-3): This category saw non-compliance rates as high as 92% and even 100% in Round 3, with total assessed duties and penalties surpassing $1.3 million.

These figures underscore the significant financial risks associated with non-compliance across various product categories.

Consequences of Failing a Trade Compliance Audit

The repercussions of failing an audit extend far beyond a slap on the wrist:

- Monetary Penalties and Back-Duties: This is often the most immediate and painful consequence. Agencies will assess back-duties on all misdeclared shipments, sometimes going back several years, plus significant penalties and fines. The statistics above provide a stark illustration of these costs.

- Shipment Delays or Seizures: Non-compliant shipments can be held at the border, leading to costly delays, storage fees, or even outright seizure of goods. This disrupts supply chains and damages customer relationships.

- Loss of Import Privileges: In severe or repeated cases of non-compliance, a company could face the suspension or revocation of its import privileges, effectively shutting down its international trade operations.

- Increased Scrutiny: Once a company has been flagged for non-compliance, it will likely face increased scrutiny and more frequent audits in the future, consuming valuable time and resources.

- Personal Liability for Corporate Officers: This is a critical and often overlooked consequence. The legal landscape has shifted, and corporate officers can now be held personally liable for illicit trade practices. In extreme cases, this could even lead to incarceration. This personal risk underscores the absolute necessity of robust compliance programs, especially when dealing with complex issues like Navigate Section 301 Tariffs.

Proactive Compliance and Risk Mitigation

Given these high stakes, a proactive approach to trade compliance audit is not just good practice—it’s essential for survival.

- Developing a Comprehensive Compliance Manual: Establish clear, written policies and procedures for all import and export activities. This manual should cover everything from classification to record-keeping and be regularly updated to reflect changing regulations. It ensures that everyone in your organization understands their responsibilities.

- Strong Internal Controls: Design and implement robust internal controls to prevent errors and detect non-compliance. This includes segregation of duties, regular internal reviews, and approval processes for critical trade decisions. Our commitment to quality control extends to every facet of our operations, including ensuring our clients’ compliance.

- Regular Employee Training: Employees are often the first line of defense. Ensure all personnel involved in international trade, from purchasing to logistics, receive comprehensive and ongoing training on trade regulations, company policies, and the consequences of non-compliance. Employees who understand trade procedures are less likely to make costly mistakes.

- Partnering with Experts: Don’t go it alone. Working with trade compliance experts, such as customs brokers, trade lawyers, or consulting firms like Altraco, can provide invaluable guidance. We can help you steer complex regulations, prepare for audits, and implement best practices. Our Integrated Supply Chain Services are designed to embed compliance throughout your entire sourcing and manufacturing process.

- Staying Informed on Regulations: The rules of international trade are constantly changing. We must actively monitor regulatory updates from agencies like CBP, CBSA, and the Office of Export Enforcement. Subscribing to trade publications and attending industry seminars can help keep us abreast of new requirements and enforcement priorities.

- Exploring Programs like CTPAT: Consider participating in voluntary compliance programs like the Customs Trade Partnership Against Terrorism (CTPAT). The CTPAT Trade Compliance Handbook offers resources for understanding this modernized program, which focuses on supply chain security and compliance. Participation can lead to benefits such as reduced inspections and expedited processing.

Conclusion

Navigating the labyrinth of international trade regulations and the prospect of a trade compliance audit can feel overwhelming. However, by understanding what these audits entail, why they are conducted, and how to proactively prepare, we can transform a potential threat into an opportunity for strengthening our business.

The message is clear: proactive compliance is our best defense. It means establishing robust internal controls, maintaining meticulous records for home improvement, sporting goods, automotive parts, and outdoor products, and continuously educating our teams. This proactive stance not only minimizes audit risks but also fosters efficiency, reduces costs, and protects our reputation and bottom line.

At Altraco, we understand these challenges intimately. As your offshore contract and private label manufacturing partner, we specialize in simplifying global supply chains. Whether we’re manufacturing your products in Mexico, China, Vietnam, or other countries, our decades of experience, trusted factory relationships, and expertise in tariff navigation are geared towards building compliant supply chains. We strive to deliver quality, on-time products with significant cost savings for our clients, all while mitigating the complex risks associated with international trade.

To de-risk your supply chain and bolster compliance, explore our International Sourcing Services. Let us help you master the maze of trade compliance, so you can focus on what you do best: growing your business.