Why Understanding China Section 301 Tariffs Is Critical for Your Business

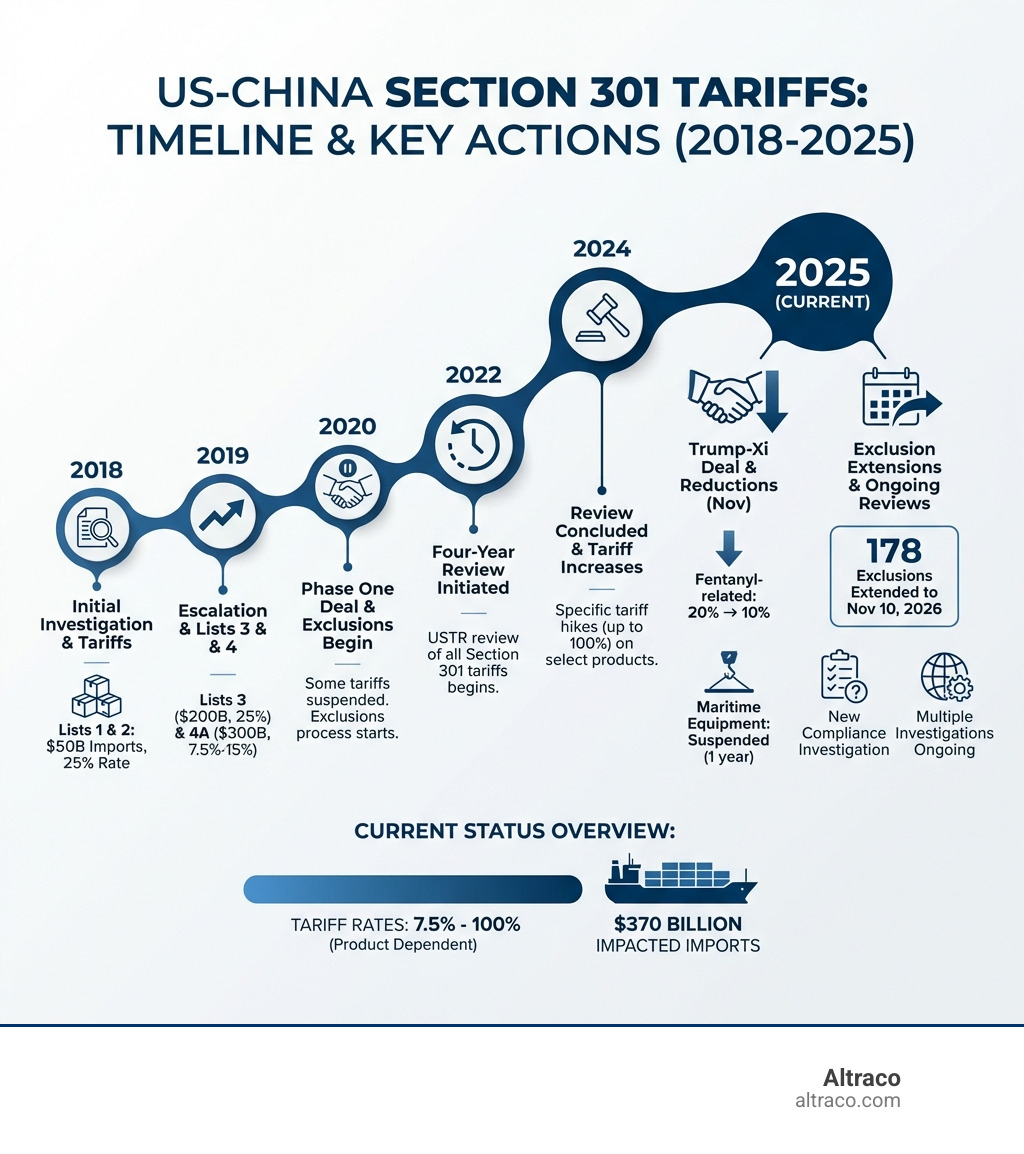

China 301 tariffs 2025 represent a complex and evolving landscape that directly impacts businesses importing goods from China. Here’s what you need to know right now:

Key Facts About China 301 Tariffs in 2025:

- 178 product exclusions have been extended through November 10, 2026

- Tariff rates range from 7.5% to 100% depending on the product category

- $370 billion worth of Chinese imports are subject to these tariffs

- New tariff reductions were announced following the Trump-Xi deal in November 2025

- Multiple investigations are ongoing that could lead to additional tariffs

The Section 301 tariffs originated from a 2018 investigation into China’s practices related to technology transfer, intellectual property theft, and forced technology transfer. Since then, these tariffs have undergone multiple reviews, extensions, and modifications.

What’s Changed in 2025:

- Fentanyl-related tariff reduced from 20% to 10%

- Certain tariffs on maritime and shipbuilding equipment suspended for one year

- New investigation into China’s compliance with the Phase One trade agreement

- Four-year review resulted in tariff increases up to 100% on specific products

As Albert Brenner, co-owner of a contract manufacturing company with over 40 years of experience, I’ve helped Fortune 500 companies steer the complexities of china 301 tariffs 2025 and develop strategies to mitigate their impact through diversified manufacturing in countries like Mexico and Vietnam. Understanding these tariffs is essential for maintaining competitive pricing and reliable supply chains for home improvement, sporting goods, automotive parts, and outdoor products.

China 301 tariffs 2025 terminology:

The Foundation: Understanding Section 301 Tariffs

The story of the china 301 tariffs 2025 begins not in the present year, but back in 2018. It was then that the U.S. Trade Representative (USTR) initiated a comprehensive investigation under Section 301 of the Trade Act of 1974. This particular piece of legislation empowers the USTR to investigate and respond to foreign country practices that are deemed unfair or discriminatory and burden or restrict U.S. commerce.

The 2018 investigation specifically targeted China’s acts, policies, and practices related to technology transfer, intellectual property, and innovation. The findings were quite clear: China was engaged in unreasonable and discriminatory practices, including intellectual property theft and forced technology transfer. These findings laid the groundwork for the imposition of additional tariffs on a wide range of Chinese imports, marking a significant shift in U.S.-China trade relations.

The Original Tariff Lists (1-4A)

Following the 2018 investigation, the U.S. imposed tariffs on approximately $370 billion worth of imports from China, categorized into four main lists. These initial lists established the foundation of the Section 301 tariffs that we continue to steer today.

- List 1: Effective July 19, 2018, this list applied a 25% additional tariff on $34 billion worth of Chinese imports.

- List 2: Introduced on August 23, 2018, this list also imposed a 25% additional tariff, covering another $16 billion in goods.

- List 3: Initially set at 10%, tariffs on this list were later increased to 25% on May 10, 2019, affecting a substantial $200 billion worth of imports.

- List 4A: Finally, this list, effective February 14, 2020, applied a 7.5% additional tariff on $120 billion worth of imports.

These tariffs, ranging from 7.5% to 25%, covered a diverse array of products, from industrial machinery and electronics to various consumer goods. For businesses involved in sectors like home improvement, sporting goods, automotive parts, and outdoor products, understanding these foundational lists is crucial, as they still influence the current tariff landscape in 2025. At Altraco, we’ve been helping our clients understand these complexities since day one, ensuring their supply chains remain robust despite these problems.

Key Developments in the China 301 Tariffs 2025

The year 2025 has been a dynamic one for china 301 tariffs, marked by significant reviews, new deals, and ongoing investigations. We’ve seen a landscape shaped by mandatory four-year reviews, a landmark deal between President Trump and President Xi Jinping, and a series of new probes into China’s trade practices. These developments have led to both tariff increases and crucial exclusion extensions, keeping businesses on their toes.

The Four-Year Review and Subsequent Tariff Hikes

A critical juncture for the Section 301 tariffs occurred with the mandatory four-year review. On May 14, 2024, the USTR released its findings from this comprehensive review, which is a statutory requirement to assess the effectiveness and necessity of the tariffs. This review wasn’t just a formality; it led to substantial changes.

The outcome was a series of further tariff increases, some reaching up to 100% on certain products. These increases began to take effect on goods entered or withdrawn from warehouse for consumption on or after September 27, 2024. The impact of these hikes has been felt across various sectors, prompting businesses to re-evaluate their sourcing strategies. For instance, the review resulted in tariffs ranging from 25% to 100% across 14 product groups.

Beyond the broad September 2024 changes, December 2024 brought additional Section 301 tariff increases on specific products, including certain tungsten products, solar wafers, and polysilicon. These targeted increases underscore the USTR’s ongoing scrutiny of particular industries. For us, this means constantly monitoring these changes and advising our clients on how to adapt, whether through global sourcing or exploring alternative manufacturing locations. You can dive deeper into the USTR’s analysis of this review by checking their USTR’s mandatory four-year review report.

The Trump-Xi Deal of November 2025

Perhaps one of the most significant developments in china 301 tariffs 2025 was the historic trade and economic deal announced between President Trump and President Xi Jinping of China on November 1, 2025. This deal brought about several key changes aimed at rebalancing trade relations and addressing specific concerns.

A major outcome of this agreement was the reduction of the “fentanyl” tariff on Chinese goods entering the U.S. This tariff, initially set at 20%, was lowered to 10% effective November 10, 2025. This reduction was part of a broader effort to stem the flow of precursor chemicals to criminal cartels and shut down money laundering.

In response to this deal, the USTR extended certain exclusions from the China Section 301 tariffs through November 10, 2026. This extension provided much-needed relief for many businesses. Furthermore, China also made reciprocal actions, agreeing to reduce its retaliatory tariffs on U.S. goods from 125% to 10% for a 90-day period and to remove non-tariff actions imposed since April 2, extending this reduction through November 10, 2025. China also removed retaliatory tariffs on US agricultural products starting November 10, 2025. These reciprocal steps signal a cautious de-escalation, at least temporarily. More details on this can be found in the President Trump and President Xi Jinping agreement fact sheet.

New Investigations and Their Impact on China 301 Tariffs 2025

Even with deals and extensions, the U.S. has continued its vigilance over China’s trade practices, initiating new investigations in 2025 that could further shape the future of china 301 tariffs.

One significant new probe was announced on October 28, 2025, when the USTR initiated a Section 301 investigation into China’s implementation of the Phase One trade agreement. This investigation aims to assess China’s compliance with commitments made in December 2019. A public hearing in connection with this investigation is scheduled for December 16, with written comments due by December 1. This new investigation highlights the ongoing scrutiny of China’s trade conduct. You can find the official notice for this Initiation of Section 301 Investigation.

Another key area of focus has been China’s semiconductor industry. An investigation into China’s semiconductor policies was completed in December 2024, with the USTR determining that China’s targeting of this industry for dominance is unreasonable and burdens U.S. commerce. While no additional tariffs were proposed for 2026, the USTR indicated a potential rate increase in June 2027, emphasizing a long-term strategic approach to this critical sector.

Finally, the USTR also completed an investigation into China’s maritime, logistics, and shipbuilding industries. This probe found China’s practices in these sectors to be unreasonable. In a notable development, 100% tariffs and certain port fees related to this investigation were suspended on November 10, 2025, for one year. This suspension, likely influenced by the broader Trump-Xi deal, offers temporary relief while underlying trade issues are presumably addressed through ongoing negotiations. These investigations illustrate the U.S.’s multi-pronged approach to addressing China’s trade practices, moving beyond just Section 301 to consider various tools and tactics.

Navigating Exclusions and Exemptions

For businesses importing goods from China, understanding and leveraging product exclusions and exemptions is like finding a hidden treasure map in a complex jungle. These exclusions can offer significant tariff relief and help mitigate the impact of the broader china 301 tariffs 2025.

The exclusion process allows specific products, identified by their Harmonized Tariff Schedule of the United States (HTSUS) codes, to be exempt from the additional Section 301 duties. This is particularly relevant for those of us dealing with home improvement, sporting goods, automotive parts, and outdoor products, where specific components or finished goods might qualify. We at Altraco understand the intricate details of HTS codes and how they can open up potential savings for our clients.

Current Status of Product Exclusion Extensions

The landscape of tariff exclusions has been continuously shifting. Initially, on May 30, 2024, the USTR issued a Federal Register notice extending 429 product-specific exclusions through June 14, 2024. However, not all these exclusions were prolonged.

Beyond that date, only 164 of those products had their exclusions continued, lasting through May 31, 2025. This constant change can be a headache for importers, requiring diligent tracking of each product’s status.

The most recent and significant development came on November 26, 2025. Following the trade deal between President Trump and President Xi Jinping, the USTR further extended certain exclusions from the China Section 301 tariffs. This extension covered 178 exclusions, which will now remain in effect through November 10, 2026. This was a welcome announcement for many businesses, providing a longer runway for planning. You can review the specifics of these extended exclusions in the official USTR notice: 178 exclusions extended to November 2026.

Special Exclusions: Machinery and Solar Equipment

Beyond the general product exclusions, specific attention has been given to certain categories, particularly machinery and solar manufacturing equipment.

A new exclusion process was proposed for machinery classified in HTS Chapters 84 and 85. This is a big deal for manufacturers, as these chapters cover a vast array of industrial machinery crucial for production. In May 2024, the USTR issued a Federal Register notice outlining the proposed information it would seek for this new exclusion process, specifically targeting machinery imported from China for manufacturing in the U.S. This initiative aims to support domestic manufacturing by providing relief on essential equipment. Further updates on this process were provided in August 2024. For more details on this proposed process, refer to the Machinery in HTS Chapters 84 and 85 notice.

Additionally, the solar industry received specific relief. On September 13, 2024, the USTR announced it had granted 14 tariff exclusions for specific solar manufacturing equipment. These exclusions were made effective from January 1, 2024, through May 31, 2025. This move highlights a strategic effort to support renewable energy initiatives and domestic solar production. Information about these specific solar exclusions can be found in this 14 tariff exclusions for solar equipment%20(FINAL).pdf). These targeted exclusions demonstrate that the U.S. government is willing to make specific concessions where it aligns with broader economic or strategic goals.

Beyond Section 301: A Broader Look at US-China Trade Actions

While Section 301 tariffs dominate much of the discussion around U.S.-China trade, they are just one piece of a much larger, more intricate puzzle. The U.S. government employs a range of legislative tools to address perceived trade imbalances or national security concerns, leading to a complex web of duties that can impact imports from China.

These various tariff actions, including Section 232 tariffs and those imposed under the International Emergency Economic Powers Act (IEEPA), often overlap. When combined with reciprocal tariffs and China’s own retaliatory measures, the result can be a significant cumulative effect on the cost of goods. Understanding how these different layers of tariffs interact is crucial for any business, especially those importing components for home improvement, sporting goods, automotive parts, and outdoor products.

Interplay with Section 232 and IEEPA Tariffs

Beyond Section 301, two other significant legal authorities frequently come into play: Section 232 of the Trade Expansion Act of 1962 and the International Emergency Economic Powers Act (IEEPA).

Section 232 allows the U.S. to impose tariffs on imports deemed a threat to national security. In 2025, we saw expanded and amended steel and aluminum tariffs proclaimed in February, with a 50% global rate and a 25% rate for imports from the UK. Automobile tariffs were also proclaimed, imposing a 25% global tariff on imports of automobiles (effective April 3, 2025) and parts (effective May 3, 2025), though specific agreements with countries like the UK, Japan, EU, and South Korea allowed for lower rates.

IEEPA, on the other hand, grants the President broad authority to regulate economic transactions in response to declared national emergencies. In 2025, this authority was invoked for several key actions:

- Trade deficit-related action (E.O. 14257): This executive order, issued on April 2, 2025, imposed a minimum global tariff of 10% (effective April 5, 2025) to address trade deficits. While China’s rate initially surged to 125%, it was later paused and reduced in negotiations. You can find details on this Trade deficit-related action (E.O. 14257).

- Fentanyl-related action (E.O. 14195): To combat the flow of precursor chemicals, an initial 10% tariff was imposed on all goods from China on February 4, 2025. This was increased to 20% on March 3, but then, as part of the November Trump-Xi deal, it was lowered back to 10% effective November 10, 2025. This action also ended de minimis duty-free treatment for low-value imports from China. More information on this is available in the Fentanyl-related action (E.O. 14195) document.

The critical takeaway here is the cumulative application of duties. Many of the 2025 tariff actions are cumulative, meaning that goods can be subject to multiple tariff rates simultaneously, significantly increasing their final landed cost. This stacking effect is a major challenge for importers, making our expertise in navigating Section 301 tariffs and other duties all the more valuable.

China’s Retaliatory Measures

Trade is a two-way street, and China has not been a passive observer in this tariff saga. In response to U.S. tariff actions, China has consistently implemented its own retaliatory measures, creating a complex “tit-for-tat” scenario that impacts U.S. exports.

In February and March 2025, in response to the U.S. fentanyl-related tariffs, China implemented retaliatory tariffs of 10-15% on selected U.S. exports. This was followed by more aggressive actions in April, where China increased its retaliatory tariffs on U.S. goods from 34% to 84% and then to 125% in response to the U.S. trade deficit-related tariffs.

Beyond tariffs, China also announced various non-tariff barriers. These included export restrictions on certain critical minerals, export controls on 12 U.S. entities, and unreliable entity designations for six U.S. companies. Such measures create significant uncertainty and operational challenges for U.S. businesses engaged in trade with China.

However, the November Trump-Xi deal brought some relief. China agreed to reduce its retaliatory tariffs from 125% to 10% for a 90-day period and to remove non-tariff actions imposed since April 2. This temporary reduction was later extended through November 10, 2025, and China also specifically removed retaliatory tariffs on US agricultural products starting November 10, 2025. This demonstrates that while trade tensions remain high, periods of negotiation can lead to temporary truces and adjustments. For us, this means staying agile and continually assessing the shifting landscape of both U.S. and Chinese trade policies.

Frequently Asked Questions about China 301 Tariffs

We often get asked critical questions about the current tariff environment. Here are some of the most common inquiries regarding china 301 tariffs 2025 and beyond.

What is the current average tariff rate on Chinese goods?

This is a dynamic figure, but we can look to reliable economic analysis for an answer. According to research from Oxford Economics, the effective tariff rate on Chinese goods entering the U.S. stood at 29.3% in November 2025. This represents a notable reduction from the 37.1% effective rate prior to the trade agreement reached between President Trump and President Xi Jinping in Kuala Lumpur at the end of October 2025. This change underscores the significant impact of high-level negotiations on the overall tariff burden. While 29.3% is still substantial, it indicates that diplomatic efforts can, at times, lead to some easing of trade tensions.

How can I find out if my product is affected by Section 301 tariffs?

Determining if your specific product is impacted by Section 301 tariffs requires a bit of detective work, but it’s entirely manageable with the right tools. The key is to identify your product’s Harmonized Tariff Schedule of the United States (HTSUS) code. Once you have this, you can:

- Check the USITC’s tariff page: The USITC’s tariff page provides a comprehensive database where you can search by HTSUS code to see current tariff rates, including any Section 301 additions.

- Review USTR exclusion lists: The USTR regularly publishes lists of products that have been granted exclusions from Section 301 tariffs. These lists are crucial, as an exclusion could mean your product is exempt, even if its HTSUS code generally falls under a tariff category.

- Seek expert advice: Given the complexities and frequent changes, we always recommend seeking expert advice. At Altraco, we specialize in helping businesses like yours steer these intricate regulations, ensuring you have the most up-to-date and accurate information for your specific products, whether they’re for home improvement, sporting goods, automotive parts, or outdoor products.

What is the outlook for US-China tariffs?

The outlook for U.S.-China tariffs in the near future remains characterized by a degree of uncertainty and continued volatility. While the November 2025 Trump-Xi deal brought some temporary reductions and extensions, the underlying trade tensions and strategic competition between the two economic powerhouses persist.

We anticipate continued ongoing negotiations, which can lead to sudden policy shifts and adjustments in tariff rates or exclusions. The political landscape, particularly with elections and changes in administration, can also dramatically influence trade policy. This environment necessitates a proactive approach to supply chain management.

For us at Altraco, this means emphasizing supply chain diversification as a core strategy. Relying heavily on a single country, especially one subject to such volatile trade policies, is a significant risk. We help our clients explore nearshoring trends, with countries like Mexico and Vietnam emerging as strong alternatives for manufacturing. By diversifying production to these regions, companies can build more resilient supply chains, mitigate tariff impacts, and ensure stability for their home improvement, sporting goods, automotive parts, and outdoor product lines. The dynamic nature of china 301 tariffs 2025 serves as a powerful reminder that adaptability is key to survival in global trade.

Conclusion: Strategizing Your Supply Chain Amidst Tariff Uncertainty

The landscape of china 301 tariffs 2025 is undeniably complex, a swirling vortex of investigations, reviews, deals, and retaliatory measures. For businesses importing goods for sectors like home improvement, sporting goods, automotive parts, and outdoor products, this complexity translates directly into significant supply chain risk. The question isn’t if tariffs will impact your bottom line, but how much, and what you can do about it.

At Altraco, we believe that proactive management and a robust diversification strategy are not just good ideas, but essential for survival and growth in this environment. We’ve spent decades helping companies, including Fortune 500s, steer these very challenges. Our expertise in contract manufacturing outside of the United States, particularly in countries like Mexico and Vietnam, offers a tangible solution. By strategically shifting production, you can minimize exposure to escalating tariffs and build a more resilient supply chain.

We specialize in taking the guesswork out of global manufacturing, from initial sourcing to quality control and logistics. Our team understands the nuances of tariff navigation, ensuring that your products are not only cost-effective but also compliant and delivered on time. Don’t let the complexities of china 301 tariffs 2025 derail your business. Let us help you transform uncertainty into opportunity.

Find how Altraco can simplify your global supply chain and mitigate tariff impacts. For more information on our services, visit More info about Altraco’s Tariff Navigation and Supply Chain Services. We’re here to help you thrive, no matter how the global trade winds blow.

Al is an entrepreneur, founder, and owner of multiple businesses, including Altraco, an outsourcing and contract manufacturing company. Working across multiple continents and trusted by Fortune 500 companies, Al finds innovative solutions to traditional supply chain challenges. He is a member of Vistage Worldwide.