Understanding the Current State of China Tariffs

China tariffs are a significant challenge for US businesses with overseas manufacturing. Here’s a quick overview:

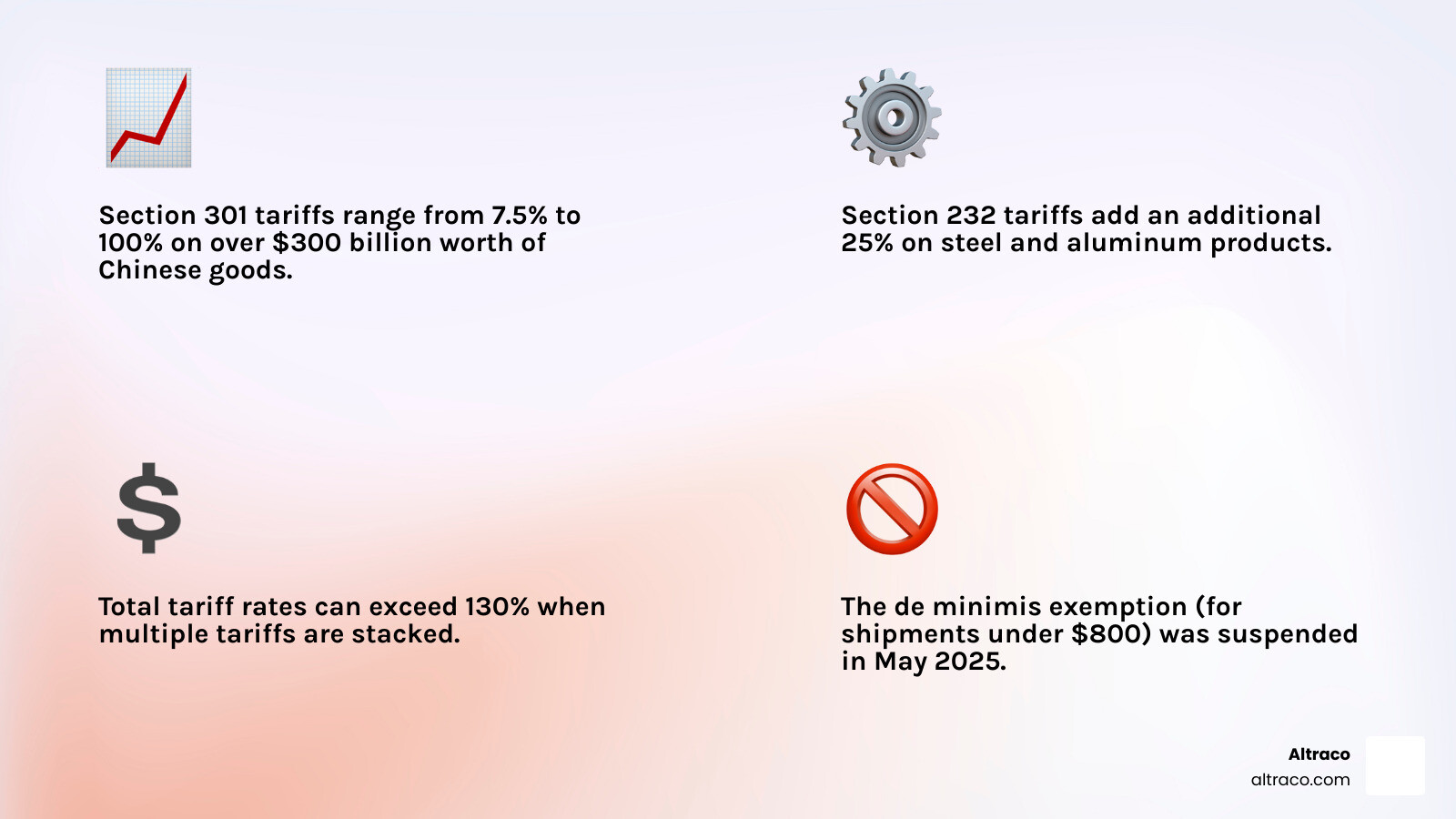

Key Facts About China Tariffs:

- Section 301 tariffs range from 7.5% to 100% on over $300 billion of Chinese goods.

- Section 232 tariffs add 25% on steel and aluminum products.

- Total tariff rates can exceed 130% when multiple tariffs stack.

- De minimis exemption (for duty-free shipments under $800) was suspended in May 2025.

- Tariff exclusions are available for some products through the USTR process.

The current tariffs stem from a trade dispute that began in 2018 with a Section 301 investigation into China’s trade practices. The resulting retaliatory measures created a complex web of duties that impact costs, supply chains, and profitability.

For companies manufacturing home improvement products, sporting goods, automotive parts, and outdoor products in China, these tariffs mean a significant cost increase that requires strategic planning and sourcing diversification.

I’m Albert Brenner. With over 40 years of experience at our contract manufacturing firm, Altraco, I’ve helped Fortune 500 companies steer china tariffs. I’ve seen how proper planning and alternative sourcing in countries like Mexico and Vietnam can turn trade challenges into competitive advantages, helping clients maintain cost efficiency despite tariff pressures.

A Brief History of the US-China Trade War

Today’s china tariffs are the result of years of trade tensions that escalated during the Trump administration. By 2017, many U.S. manufacturers and policymakers argued the trade relationship with China was one-sided, citing concerns over intellectual property theft and forced technology transfer.

President Trump made these issues central to his America First Trade Policy memorandum, arguing that China’s unfair practices required a strong response. This led to an escalating exchange of retaliatory tariffs that reshaped global trade. The U.S. imposed duties on Chinese goods, and China responded in kind, affecting billions of dollars in trade.

The impact disrupted global supply chains, forcing companies to reconsider their manufacturing strategies in China. Many of these tariffs remain in effect, forming the basis of the current trade environment.

The Origins of Section 301

Section 301 of the Trade Act of 1974 provides the legal authority for these tariffs. It allows the U.S. Trade Representative (USTR) to investigate and act against unfair trade practices.

In March 2018, a USTR investigation concluded that China was systematically pressuring U.S. companies to transfer valuable technology and innovation for market access. The report documented requirements for joint ventures and proprietary information sharing, which threatened America’s competitiveness in critical sectors.

These findings justified the initial tariff lists. The first round of Section 301 tariffs targeted $50 billion of Chinese imports. After China retaliated, the U.S. expanded the lists to cover hundreds of billions more, creating the complex tariff structure we have today.

Understanding this history is crucial for businesses manufacturing automotive parts, sporting goods, or home improvement products, as it explains why certain products face higher duties. The lists were strategically designed to penalize specific practices and protect certain industries.

You can find more details on the USTR’s official page: More info about the Section 301 investigation.

Understanding the Current China Tariffs Landscape

Navigating today’s china tariffs is complex, as multiple layers of duties can apply to a single product, significantly impacting your bottom line.

Section 301 tariffs, resulting from the USTR’s investigation into China’s IP practices, range from 7.5% to 25%, with some strategic goods facing rates up to 100%. On top of these, Section 232 tariffs add a 25% duty on steel and aluminum imports deemed a threat to national security. This is particularly relevant for automotive parts and home improvement products.

This tariff stacking means a product might face a standard duty, a Section 301 tariff, and a Section 232 tariff, with combined rates sometimes exceeding 130%.

Key changes have also impacted importers. The de minimis exemption suspension in August 2025 means even small shipments under $800 are now subject to duties. Furthermore, companies caught using third countries to evade tariffs face steep transshipment penalties of 40% on top of regular duties.

Understanding these layers is critical for calculating the true landed cost of your products. At Altraco, we help clients analyze these costs and explore manufacturing alternatives in countries like Mexico and Vietnam, where USMCA benefits or lower tariffs offer competitive advantages.

For more on managing these duties, see our guide: Navigate Section 301 Tariffs.

Key Industries Affected by China Tariffs

These tariffs have fundamentally changed the economics of manufacturing for several key industries:

- Automotive parts: Hit by both Section 232 tariffs on steel and aluminum and Section 301 tariffs on electronics and components, increasing raw material and production costs.

- Sporting goods: Complex supply chains for items like exercise equipment and fitness trackers face increased costs on metal frames and electronic components.

- Home improvement products: A vast range of items, from tools and hardware to fixtures, are affected by tariffs on metal components and other materials, raising construction and renovation costs.

- Outdoor products: Tariffs have squeezed margins on camping gear and specialized equipment in an already competitive market.

Other sectors under pressure include semiconductors, maritime equipment (with some ship-to-shore cranes facing 100% tariffs), and commercial aviation. The breadth of affected industries highlights the need to rethink where and how products are made. For detailed rates, visit our Current China Tariffs page.

Exemptions and Exclusions from China Tariffs

Relief from these duties is possible through several mechanisms, though they require expertise to steer.

The primary path is the USTR exclusion process, where companies can petition to temporarily exempt specific products from Section 301 tariffs. A successful petition typically argues that the tariffs cause disproportionate economic harm or the product is unavailable elsewhere. For example, the USTR extended 178 exclusions through November 29, 2025.

The USTR also conducts a statutory four-year review to assess if tariffs are still serving their purpose, which can lead to modifications. Recently, this process led to a new application process for exclusions on certain machinery used in domestic manufacturing and for solar manufacturing equipment.

Other potential exemptions include:

- Savings clauses: These may protect goods that were already in transit when new tariffs took effect.

- Aerospace exemption: Products covered under the WTO Agreement on Trade in Civil Aircraft can sometimes be exempt.

Successfully claiming these exemptions requires meticulous attention to your product’s HTSUS code (Harmonized Tariff Schedule). Since exclusions are often temporary and subject to change, continuous monitoring and professional guidance are essential for maximizing relief and planning for the future.

The Rationale and Global Impact of Escalating Tariffs

Understanding the “why” behind the escalating china tariffs reveals a conflict over fairness, national security, and economic leverage.

U.S. Rationale and President Trump’s Statements:

From the U.S. perspective, the rationale was that China’s trade practices were unfair. President Trump, who called tariffs a powerful negotiating tool, used them to exert maximum pressure on Beijing. The proposed additional 100% tariff on Chinese goods from November 1 was part of this strategy to achieve a “fair deal” and address what the administration saw as China “ripping off our country.” The U.S. believed it held a stronger negotiating position, fueling an aggressive tariff strategy.

China’s Strategic Actions: Rare Earth Minerals:

A major catalyst for U.S. tariff threats was China’s control over rare earth minerals. These 17 elements are essential for modern technology, including smartphones, electric vehicles, and defense systems. China dominates the processed rare earths market, controlling over 90% of the global supply.

When China tightened its export controls on these minerals, it was seen as a strategic move to weaponize its control over essential resources. The U.S. viewed this as a direct threat to its tech manufacturing and national security, prompting a severe tariff response.

Diplomatic Negotiations and Impasse:

Despite the escalating tensions, diplomatic negotiations have been ongoing. Both sides have an interest in de-escalating a costly trade war, with high-level meetings between leaders serving as critical junctures. However, finding a lasting resolution is difficult, as both nations seek to protect their interests, often leading to an impasse. This uncertainty forces companies manufacturing home improvement products, sporting goods, and automotive parts to re-evaluate their supply chains and explore diversification with partners like Altraco.

China’s Retaliation and the Ripple Effect

China’s countermeasures to U.S. tariffs were swift and strategic, creating a ripple effect across global trade.

Targeted Tariffs on U.S. Goods:

Beijing’s retaliatory tariffs targeted vital U.S. economic sectors. A 15% tariff on U.S.-origin chicken, cotton, corn, and wheat hit American farmers hard. The energy sector was also affected, with a 15% tariff on supercooled natural gas and a 10% tariff on U.S.-origin crude oil.

Export Controls on Critical Minerals:

China also announced export controls on materials like tungsten, molybdenum, and rare earth-related items, mirroring U.S. concerns and threatening to disrupt global tech manufacturing.

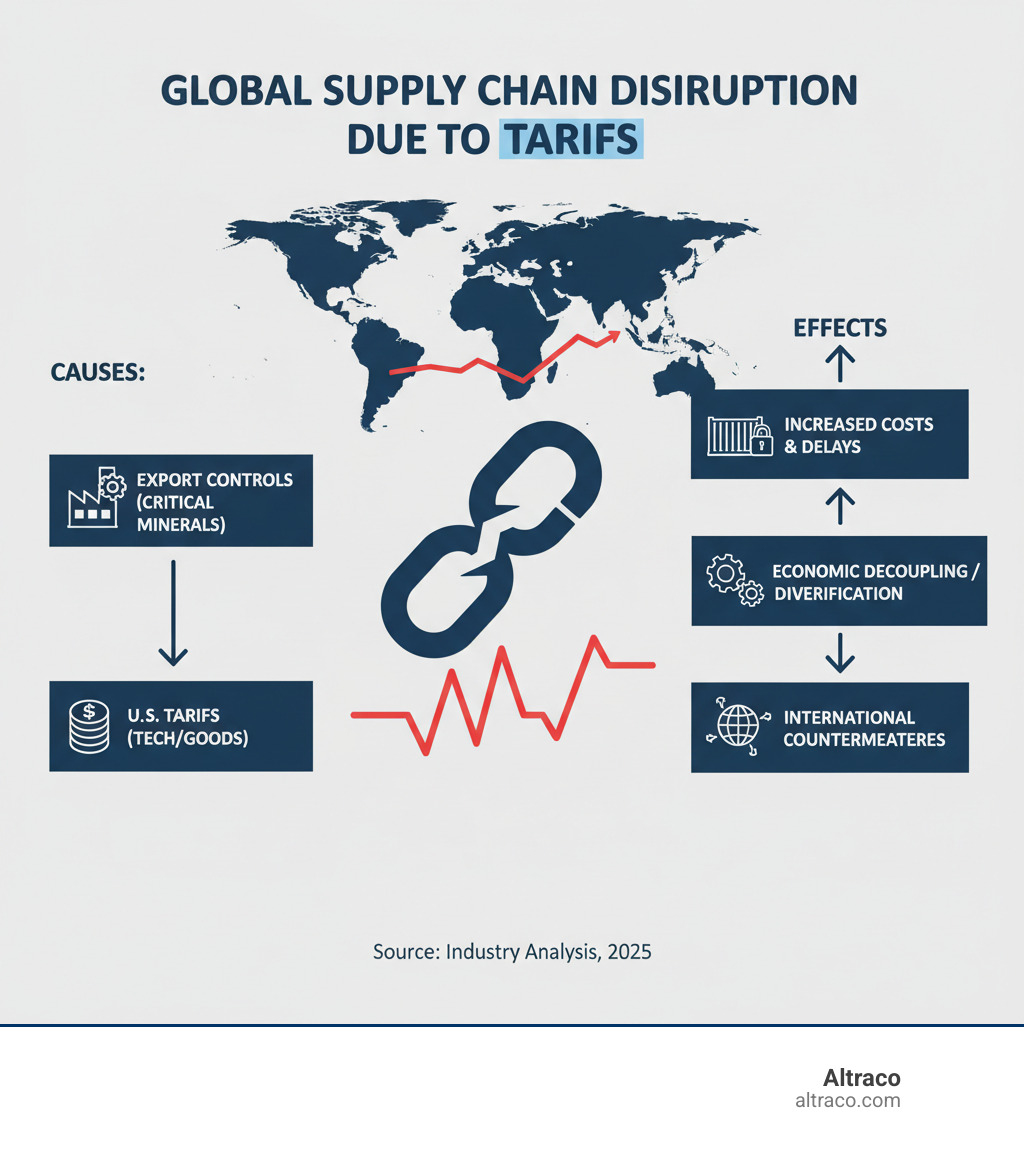

Global Supply Chain Disruption and Economic Decoupling:

The trade war has caused significant global supply chain disruption, fueling discussions about economic decoupling—the separation of the U.S. and Chinese economies. This trend has pushed companies to diversify their manufacturing away from China to reduce risk. The U.S. also holds non-tariff leverage, such as control over semiconductors and chip design software, which represents another front in the trade war.

International Reactions and Countermeasures:

Other nations have also responded. Mexico has proposed tariffs of up to 50% on certain Chinese products, while the EU has explored countermeasures to U.S. tariffs. These developments highlight the need for businesses to build resilient supply chains by exploring manufacturing in countries like Mexico and Vietnam. Learn more in our guide: Outsourced Manufacturing: The Guide to Navigating US Tariffs.

Frequently Asked Questions about China Tariffs

We hear the same questions about china tariffs from businesses trying to steer the complex trade landscape. Here are straightforward answers to the most common ones.

What are Section 301 tariffs?

Section 301 of the Trade Act of 1974 gives the U.S. Trade Representative (USTR) authority to respond to unfair foreign trade practices. The current Section 301 china tariffs stem from a USTR investigation that found China was engaging in intellectual property theft and forced technology transfer. The tariffs, which range from 7.5% to 100% depending on the product, are designed to apply economic pressure on China to reform these practices.

How do I know if my products are affected by China tariffs?

First, identify your product’s Harmonized Tariff Schedule (HTSUS) code. This classification number is essential, as it determines the applicable tariff rate. Your customs broker can help you find the correct code. Once you have the HTSUS code, you must cross-reference it with the official tariff lists published on the USTR’s website. Also, check for product-specific exclusions, which can exempt your goods from tariffs even if the HTSUS code is on a list. At Altraco, we regularly guide clients through this classification and exclusion process to minimize costs.

Are the threatened 100% tariffs on Chinese goods in effect?

As of late 2025, a blanket 100% tariff on all Chinese goods has not been implemented. The threat has been used as a negotiating lever. However, the situation is complex. Specific products, such as certain ship-to-shore cranes, do face a 100% tariff. Additionally, when different tariff types are stacked (Section 301, Section 232, anti-dumping duties), the cumulative rate on certain products can exceed 100%. The situation is fluid, so it’s crucial to monitor USTR announcements.

The unpredictability of the tariff landscape is why many companies are diversifying manufacturing away from China to locations like Mexico or Vietnam. This strategy reduces tariff exposure and builds a more resilient supply chain. For more insights, see our guide on tariffs on products from China.

Conclusion

The world of china tariffs is complex and unlikely to simplify. As we’ve seen, from Section 301 investigations to tariff stacking that can push duties beyond 130%, relying solely on Chinese manufacturing carries significant risks for your automotive parts, sporting goods, home improvement products, or outdoor products.

In this environment, supply chain flexibility is your greatest asset. The companies that thrive are those that position themselves to adapt to a trade landscape where yesterday’s strategy may not work tomorrow.

Strategic diversification is essential. By establishing manufacturing in countries like Mexico and Vietnam, businesses can mitigate tariff impacts and build more resilient supply chains. Mexico offers proximity and USMCA benefits, while Vietnam provides skilled labor and growing infrastructure. These are proven pathways we’ve helped numerous clients steer successfully.

At Altraco, we specialize in this strategic problem-solving. For over 40 years, we’ve helped clients, including Fortune 500 companies, build relationships with reliable factories in alternative locations, manage quality control, and create supply chains that are both financially and operationally sound.

China tariffs are a reality, but they don’t have to dictate your business strategy. With the right partner, you can turn this challenge into a competitive advantage.

Ready to explore how strategic sourcing can protect your business from tariff volatility? Let’s talk about building a supply chain that works for you.

Learn how to navigate tariffs on products from China